Intro to microeconomics

Economics is the study of choices under scarcity

Opportunity cost: value of the next best alternative An individual’s opportunity cost increases when the next best alternative becomes more valuable.

Marginal means a little bit more/less

- in economics the word “marginal” means the derivative or slope of a curve If you think at the margin, you are thinking about what the next or additional action means for you. Thinking on the margin can help you find an answer to an otherwise difficult question

Marginal Cost (MC): The additional cost incurred from producing one more unit of a good or service. This includes costs like materials, labor, and other expenses directly tied to that extra unit.

Marginal cost comes from the POV of the seller while opportunity cost comes from the POV of the buyer

Marginal Benefit/utility (MB): The additional benefit or utility gained from consuming or producing one more unit of a good or service. This can be measured in revenue, customer satisfaction, or any other relevant metric.

Businesses compare MC and MB to maximize profits. They produce until MC = MB.

You shouldn’t focus on what you paid for an item (if you’re trying to for example, sell it). This cost is sunk Ignore what you can’t change and focus on the future

Supply, Demand and Equilibrium

When the price of a good increases, the quantity demanded decreases because it is less affordable When the price of a good decreases, the quantity demanded increases because it is more affordable and people are willing to buy more if it

Along the supply curve, if the price of a good falls, the quantity supplied will decrease because the supplier will make less profit

Buyers don’t compete against sellers. Buyers compete against other buyers. Sellers compete against other sellers. At an auction, The buyer with the highest bid gets the item and the seller with the lowest price gets the sale

If the price in a market is above the equilibrium price, this creates a surplus.

When the price is above the equilibrium price, greed (in other words, self-interest) tends to push the price down. When the price is high, this means that QD(quantity demanded > quantity supplied). Sellers (in their own self-interest) seek to make more profits and thus make more goods, which drives prices down since the supply increases

5 factors that can change market demand:

- Income

- For most goods (normal goods), as your income goes up, you demand more of the good e.g. clothing

- For some rare goods (inferior goods), as your income goes up, you demand less of the good e.g. ramen noodles

- Population e.g. If there are more older people in your country, the demand for hearing aids goes up

- Tastes e.g. if the keto diet becomes more popular, the demand for steak will increase

- Related goods

- Substitutes e.g. if the price of a Mac goes down, the demand for Windows PCs will go down

- Complements e.g. if the demand for burger meat goes up, so does the demand for buns

- Expectations e.g. if a video game sale is going up next month, the demand this month decreases you don’t need to memorize the list above. You just need to understand how these shifters affect demand

Change in quantity demanded is a movement along a fixed demand curve, caused by a change in price(higher price, lower quantity) Change in demand refers to a shift in the demand curve, caused by one of the shifters we mention above (income, preferences etc.)

Supply shifters:

- The most basic shifter is a change in costs. The real question is how do the following change costs?

- Technological innovation: makes costs cheaper

- Input prices: More expensive inputs (raw materials) means higher costs, which means less supply (shift supply curve to the left)

- Taxes and subsidies: taxes increase cost, subsidies decrease cost

- Expectations: If a seller knows the price of a good will be more expensive in the future, they will buy more of it and store it

- Entry and exit of producers: more producers means more supply of a good

- Changes in opportunity costs: e.g. if some piece of land grows soy beans, and the price of wheat goes up, the farmer will remove some chunk (or all) of the soy beans to make room for the wheat since it makes more money. This causes less supply of soy beans since the farmer has better things to do with the land.

Whatever the supply shifter is, figure out its effects on costs:

- If costs increase, supply decreases

- If costs decrease, supply increases

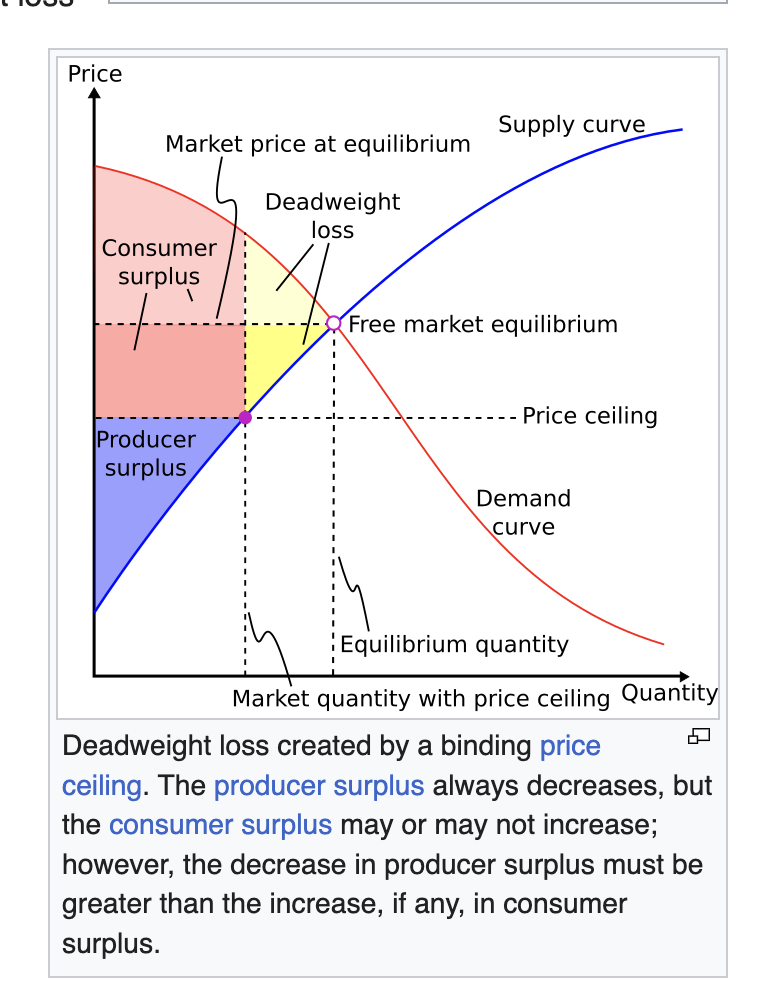

Consumer surplus is the difference between the maximum price buyers are willing to pay for a given quantity and the market price they actually paid. Basically, it is the extra value/satisfaction a consumer receives from a purchase.

Producer surplus is the difference between the price sellers were actually paid and the minimum price they would accept for a given quantity. Basically, it is the *extra benefit that a seller receives from selling a good or service at a price higher than what they were willing to accept i.e. profit

Total surplus is the sum of consumer surplus and producer surplus. Conceptually, the demand curve represents the value (or willingness to pay) for consumers, while the supply curve represents producers’ costs. Total surplus is created because buyers value the strawberries more than it costs sellers to produce them.

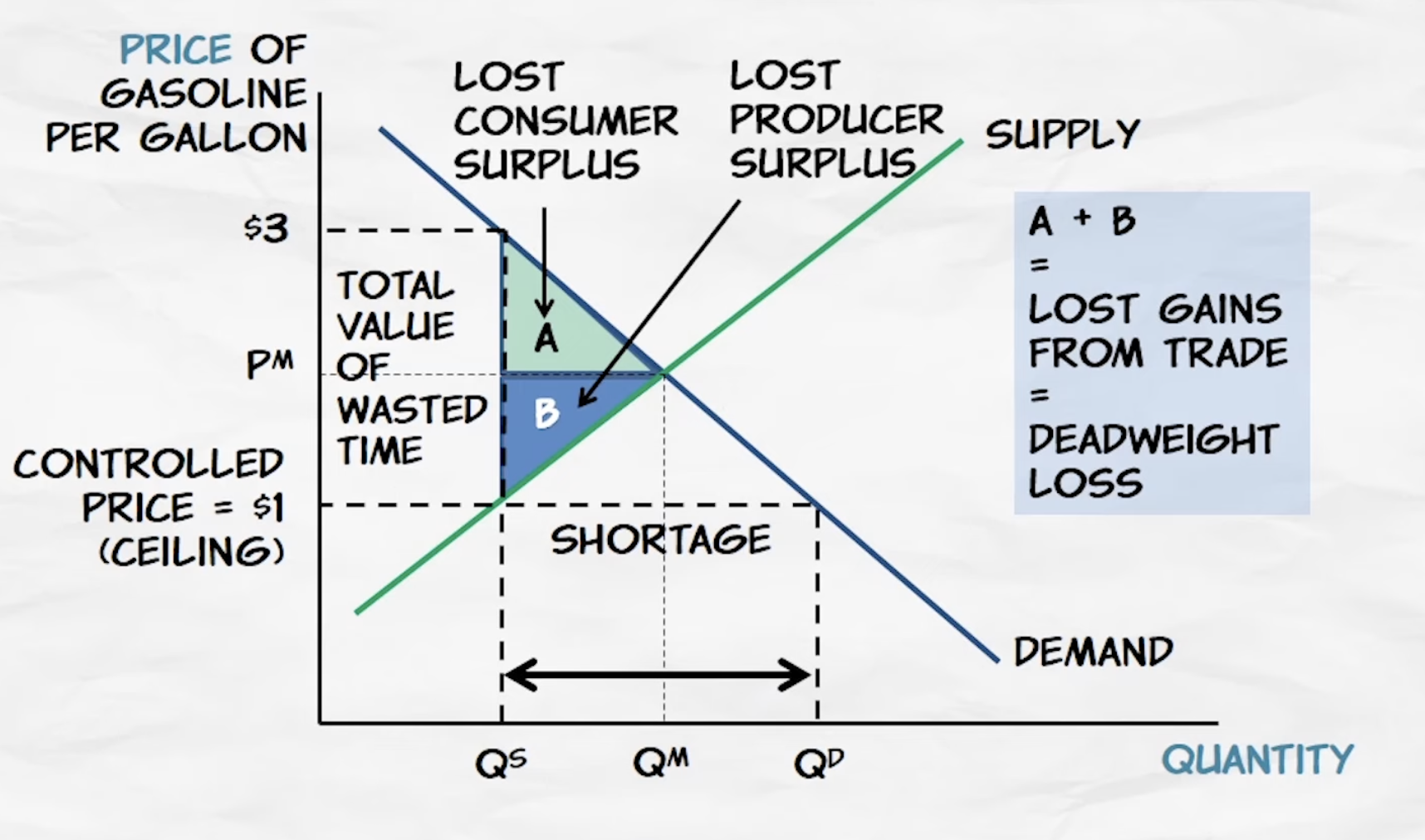

The deadweight loss is the reduction in the total surplus when the market is not in equilibrium. It represents the loss of potential benefit to society. In other words, there are either goods being produced despite the cost of doing so being larger than the benefit, or additional goods are not being produced despite the fact that the benefits of their production would be larger than the costs.

Consumer value is willingness to pay.

The demand curve represents the value (or willingness to pay) for consumers, while the supply curve represents producers’ marginal costs

Q. If oil executives read in the newspaper that massive new oil supplies have been discovered under the Pacific Ocean but will likely only be useful in 10 years, what is likely to happen to the supply of oil today? A. The supply of oil will rise today

Q. When demand increases, what happens to price and quantity in equilibrium? Price increases and quantity increases

Q. When supply increases, what happens to price and quantity in equilibrium? Price decreases and quantity increases

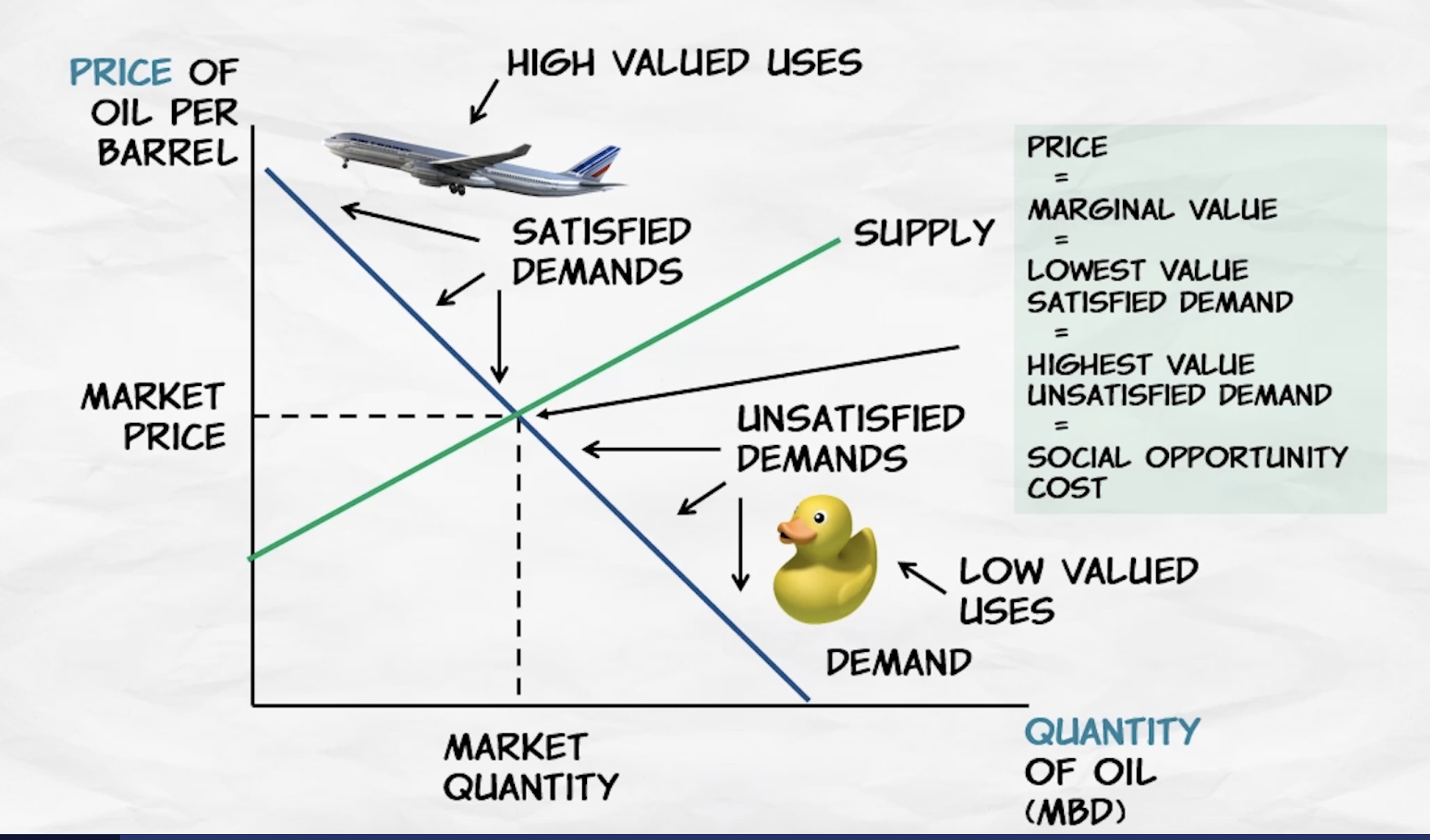

Refer to the equilibrium model diagram.

Elasticity and its applications

Elasticity of demand

Elasticity means how responsive is the quantity demanded to a change in the price of a good.

- If a small change in price causes a large change in quantity demanded, the demand for that good is elastic

- If a small change in price causes a small/unnoticeable change in quantity demanded, the demand for that good is inelastic A flatter demand curve is the more elastic curve

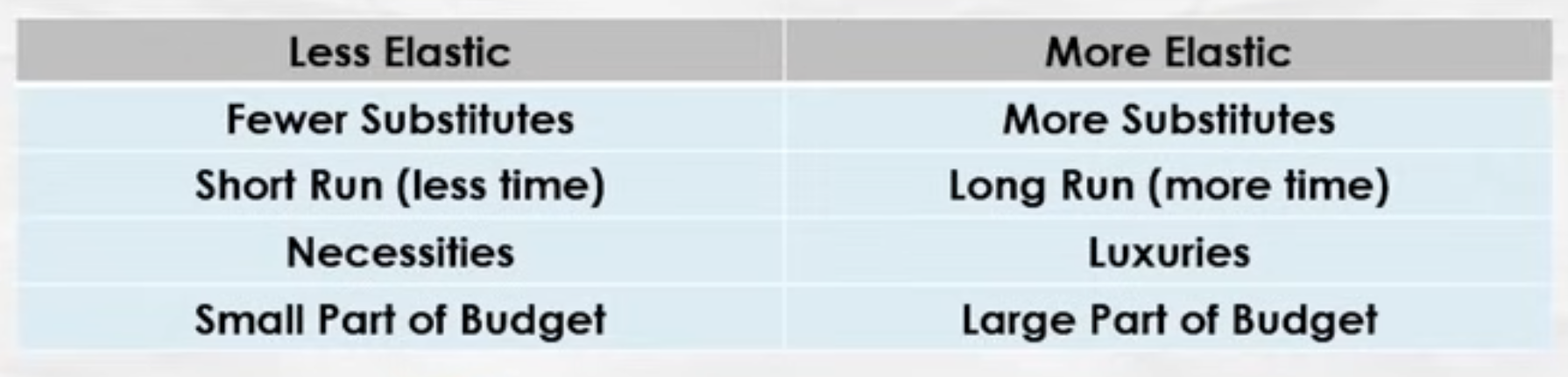

Determinants of elasticity of demand

- Availability of substitutes*** This is the fundamental determinant. When the price of a good with a lot of substitutes goes up, the quantity demanded will fall a lot

- Time horizons: Following a price increase, consumers may not be able to adjust their consumption patterns (making demand inelastic), but over time, they can adjust their behaviour by making substitutes (making demand elastic). e.g. if the price of oil goes up, right now consumers may not be able to immediately switch to alternatives (EVs, bikes, mopeds) but over time, they will move closer to the city and buy mopeds, reducing their need for cars and thus less demand for oil. The longer the time horizon, the more the ability to adjust, the more substitutes, and thus the more elastic demand

- Categories of product (specific or broad): The broader the classification, the more consumers will be able to find a substitute (thus making demand more inelastic) and vice versa. If the price of Bayer aspirin, goes up, consumers could buy generics. If the price of all aspirin goes up, there are fewer substitutes

- Necessities vs luxuries: For necessities, consumers do not change their quantity demanded when the price changes (making demand inelastic). Luxuries are more elastic

- Purchase size (relative to consumers budget): Consumers are much more concerned about price changes when the good feels expensive e.g. Consumers notice when the prices of cars go up because it’s a large purchase (thus making demand elastic) but when the price of toothpicks go up, most people dont notice (making demand inelastic)

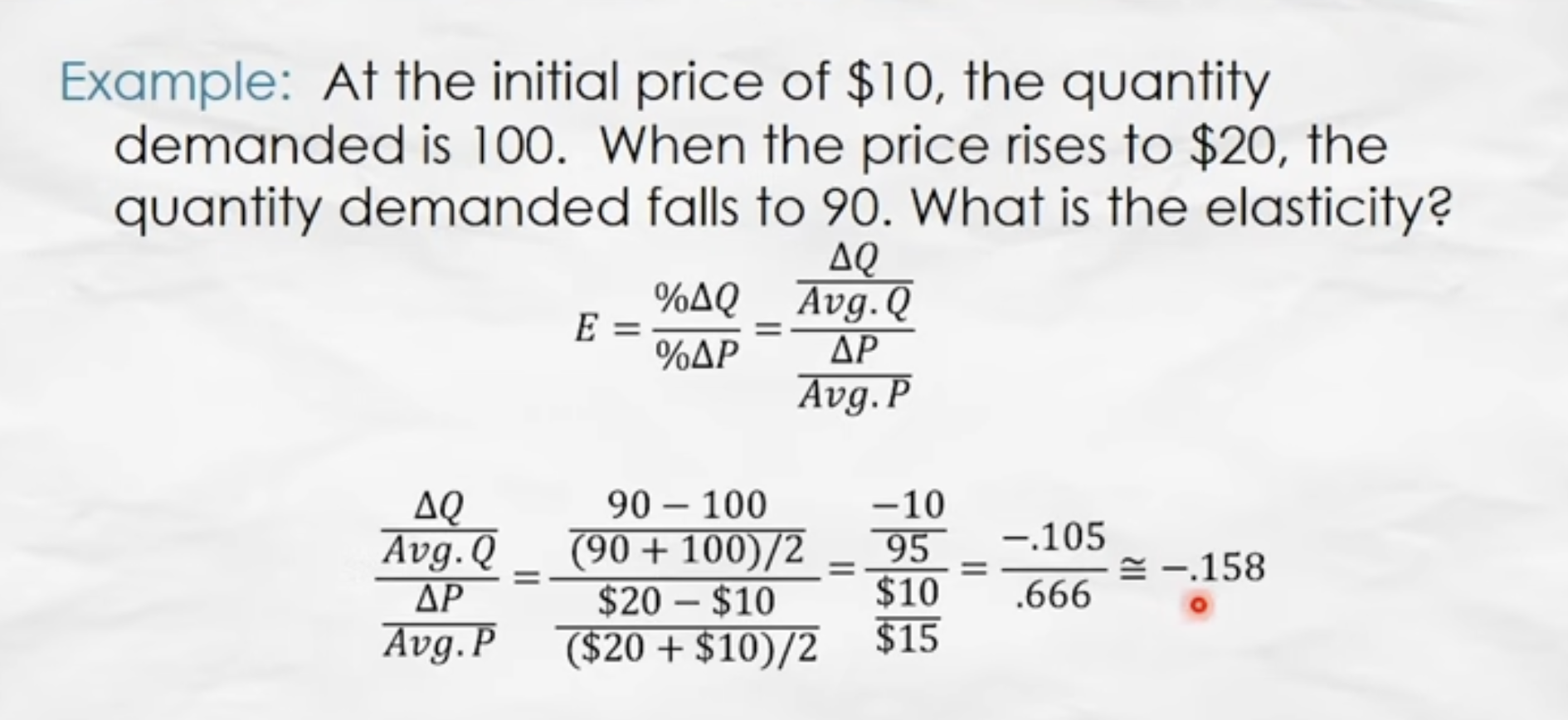

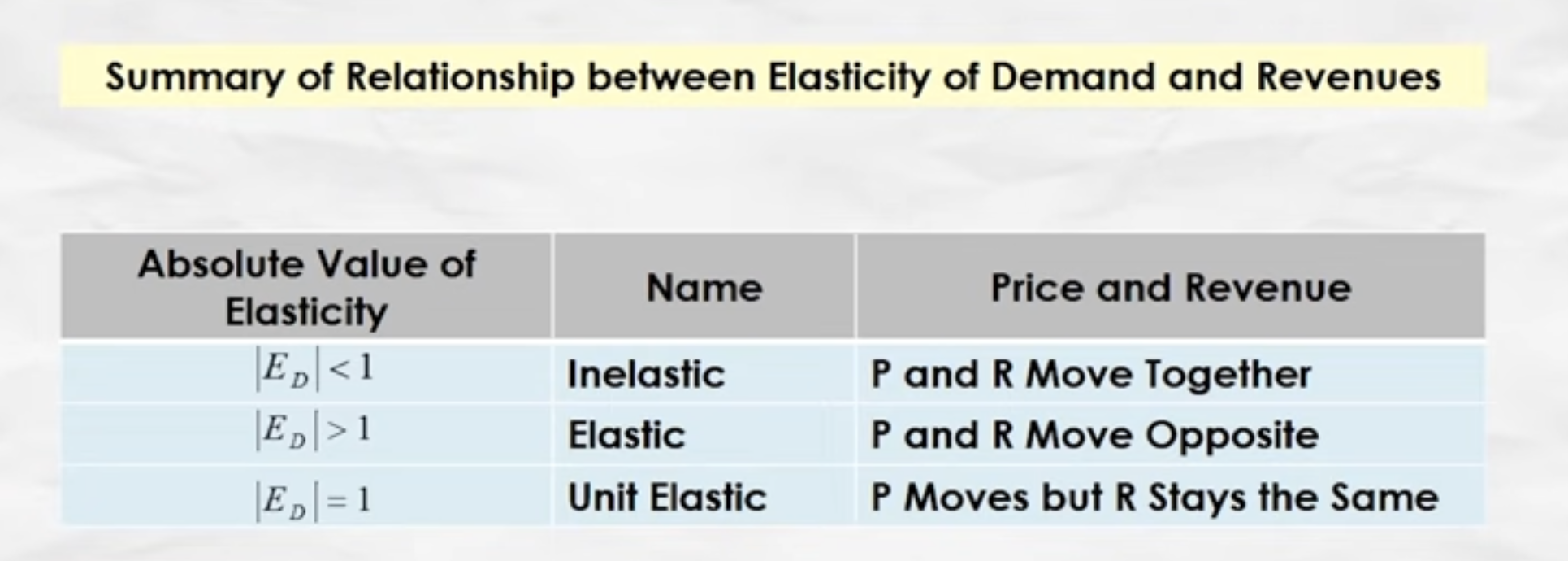

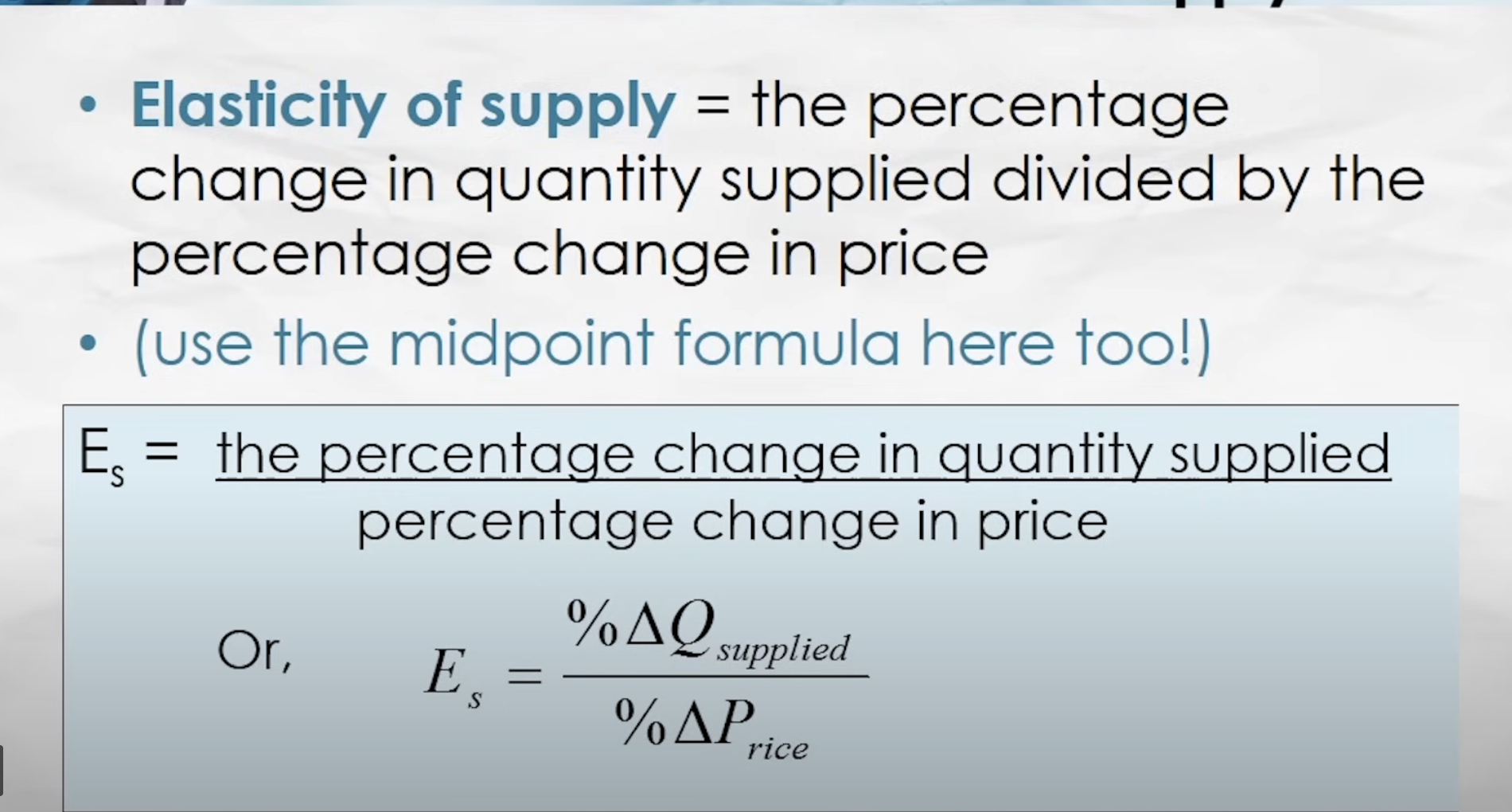

Elasticity of demand= the percentage change in quantity demanded divided by the percentage change in price

If elasticity of demand > 1, the demand curve is elastic If elasticity of demand < 1, the demand curve is inelastic If elasticity of demand = 1, the demand curve is unit elastic

Revenue = Price x Quantity Revenues fall as price rises with an elastic demand curve

Why is the war on drugs so hard to win? Because demand for most illegal drugs is inelastic, drug dealers earn more revenue and gain more power as they war becomes more effective

Q. In your college town, real estate developers are building thousands of new student-friendly apartments close to campus. If you want to pay the lowest rent possible, should you hope that demand for apartments is elastic or inelastic? A. Inelastic. Building more houses shifts the supply curve to the right. If the demand curve is inelastic, then with more quantity demanded, the price goes down by a lot whereas if the curve is elastic, more houses (more quantity demanded) only makes the price of a house go down by a little)

Q. In your college town, the local government decrees that thousands of apartments close to campus are uninhabitable and must be torn down next semester. If you want to pay the lowest rent possible, should you hope that demand for apartments is elastic or inelastic? A. Elastic. Tearing down houses shifts the supply curve to the left. If the demand curve is elastic, then a big decrease in the quantity of houses will increase the price by only a little, whereas if the demand curve is inelastic, a small shift in house quantity will increase the price the price by a lot In the case of shortages in housing, the landlords want the demand curve to be inelastic because the equilibrium price is a lot higher (they could charge a lot more for a small shift in the supply of the houses)

Elastic demand means consumers are very responsive to changes in price.

Elastic demand is price sensitive. Small changes in price lead to large changes in quantity demanded Inelastic demand is not as price sensitive. Large changes in price lead to small changes in quantity demanded

Elasticity has nothing to do with slope, but generally the flatter curve is the more elastic one.

Elasticity of supply

Measures how responsive the quantity supplied is to a change in price

A supply curve is said to be elastic when an increase in price increases the quantity supplied by a lot (and vice versa) A supply curve is said to be inelastic when the same increase in price increases the quantity supplied by a little (and vice versa)

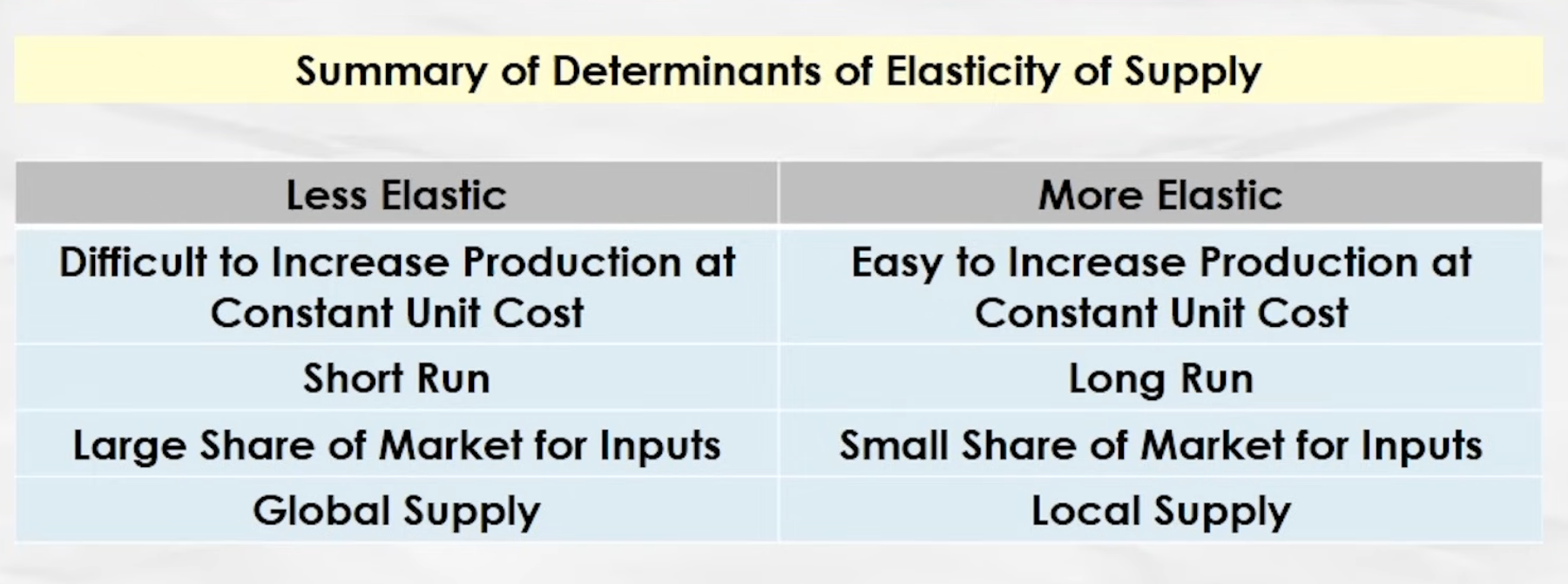

Determinants of elasticity of supply:

- Change in per-unit costs with increased production***: The cost of producing way more toothpicks is very small (small increase in price, but way more supply) so you can call the toothpick supply curve elastic

- Time horizon: Immediately following a price increase, producers can expand output using only their current capacity (making supply inelastic) e.g. grain farmers can only supply as much as their acreage allows, and they can plough a little bit more to extract some extra grain (for more cost and thus higher prices), but they’d have to wait until the next planting season to plant way more grain (making supply elastic)

- Share of market for inputs: Supply is inelastic when the industry is a big demander of the input markets e.g. cars require a lot of steel so in order to expand the supply of cars, a lot of steel is demanded, which pushes up the price of steel, which is going to make making cars more expensive (cause of higher input costs like steel), which will make the price of cars very expensive

- Geographic scope: The narrower the market of a good, the more elastic its supply. If there is an influx of cars in DC, they’re going to need more gasoline. This can be easily borrowed from neighbouring states which keeps the price of gas constant (more elastic). But if there is a worldwide shortage of gas, we need to find more expensive methods of extracting it, which makes the price of gas go up a lot (more inelastic)

Why is housing so unaffordable? Many big cities (where a lot of people want to work) have inelastic housing supply curves, meaning that when there is a small increase in the housing supply can make the price of housing go up by a lot. This is because of:

- natural factors (there just isn’t enough space or natural resources for everyone)

- zoning laws

- bureaucracy (in SF it takes on average 627 days to get a building permit) and the development can still be vetoed

Do local gun buybacks work? No. The local gun supply curve is almost perfectly elastic (because the supply of guns can easily fluctuate due to easy access to a larger, nation-wide gun market) meaning that the market price almost always remains the same even when the quantity demanded increases, meaning that people will just make more guns/get guns from outerstate and sell them to the police for higher revenues

Q. Under which conditions are gun buybacks most likely to reduce the supply of guns? A. When supply is perfectly inelastic. A right shift in the demand curve of guns (because of more buyers in the market a la police) will raise the market price (equilibrium) by a lot, which reduces consumer demand

The quantity on a supply and demand curve chart is the quantity exchanged

Taxes and Subsidies

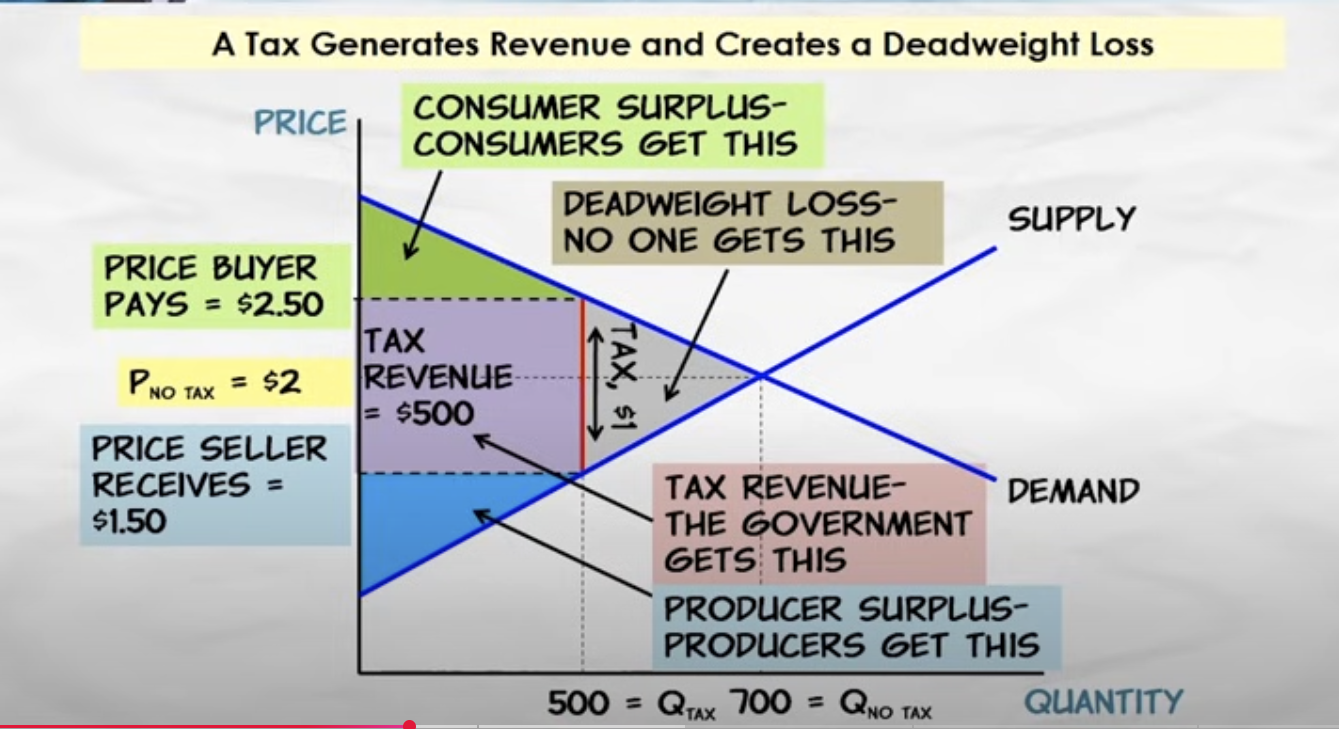

A commodity tax is a tax on goods

- who pays the tax doesn’t depend on who writes the check to the government

- who pays the tax depends on relative elasticities of demand and supply

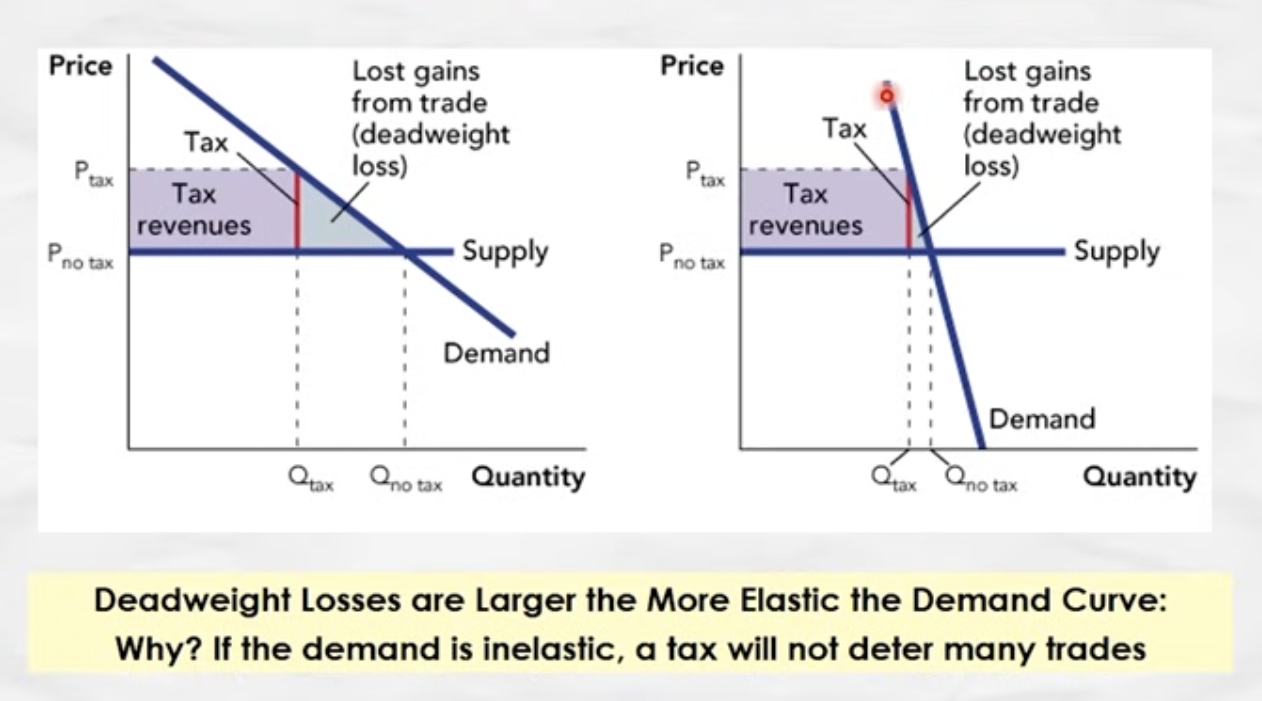

- commodity tax raises revenue and creates lost gains from trade (dead-weight loss)

The more elastic side (supply vs demand curve) of the market will pay a smaller share of the tax The more inelastic side of the market will pay a larger share of the tax e.g. when the supply curve is more elastic than demand, the buyers pay more of the tax

A good heuristic: Elastic = Escape! Elastic demand means that demanders have good substitutes so they can escape the tax Elastic supply means the resources used to produce the taxed good can easily be moved to other industries so they can escape the tax (producers have a choice to substitute what they produce) However, someone has to pay the tax so the burden is determined by relative elasticities

Q. Junk food has been criticized for being unhealthy and too cheap, enticing the poor to adopt unhealthy lifestyles. Suppose that the state of Oklakansas imposes a tax on junk food. For the tax to actually deter people from eating junk food, should junk food demand be elastic or inelastic? A. Elastic. If demand curve is elastic, consumers are sensitive to price changes which means a tax will make them consider other options

Q. Let’s take a look at the supply side of junk food. If junk food supply is highly elastic—perhaps because it’s not that hard to start selling salads with lowfat dressing instead of mayonnaise- and cheese-laden burgers—will a junk food tax have a bigger effect if supply were inelastic or elastic? A. Elastic. If supply is elastic, a tax will mean they will consider making other goods that will give them better margins

Q. If a government is hoping that a small tax can actually discourage a lot of junk food purchases, it should hope for: A. Elastic demand and elastic supply

Q. One way governments have tried to collect taxes from the wealthy is through the use of luxury taxes, which are exactly what they sound like: taxes on goods that are considered luxuries, like jewelry or expensive cars and real estate. What is true about the demand for luxuries? A. They are elastic (easily substitutable)

Q. Consider jewelry. Is a luxury tax more likely to hurt the buyers of jewelry, or the sellers of jewelry? A. The sellers the buyers will just stop buying luxuries (since they don’t need them) and the sellers won’t make money

*Let’s say you wanted to take a trip. Cost of trip is $40 Benefit of trip is $50 So you gain $10 worth of value from going on the trip So you take the trip

*Now let’s say there is a $20 tax Cost of the trip is now $60 So you choose to not go since cost > benefit

The govt gets $0 in tax revenue The deadweight loss is $10 (value of the trips not made because of the tax)

Deadweight loss is the value of the trades not made (lost gains from trade)

We don’t want to deter many trades so we should tax inelastic goods

What happened when the government tried to tax yachts (elastic demand)…

Q. Suppose that Maria is willing to pay $40 for a haircut, and her stylist Juan is willing to accept as little as $25 for a haircut. If the state where Maria and Juan live instituted a tax on services that included a $5 per haircut tax on stylists and barbers, what will happen to the $15 of economic benefit? A. It will stay the same

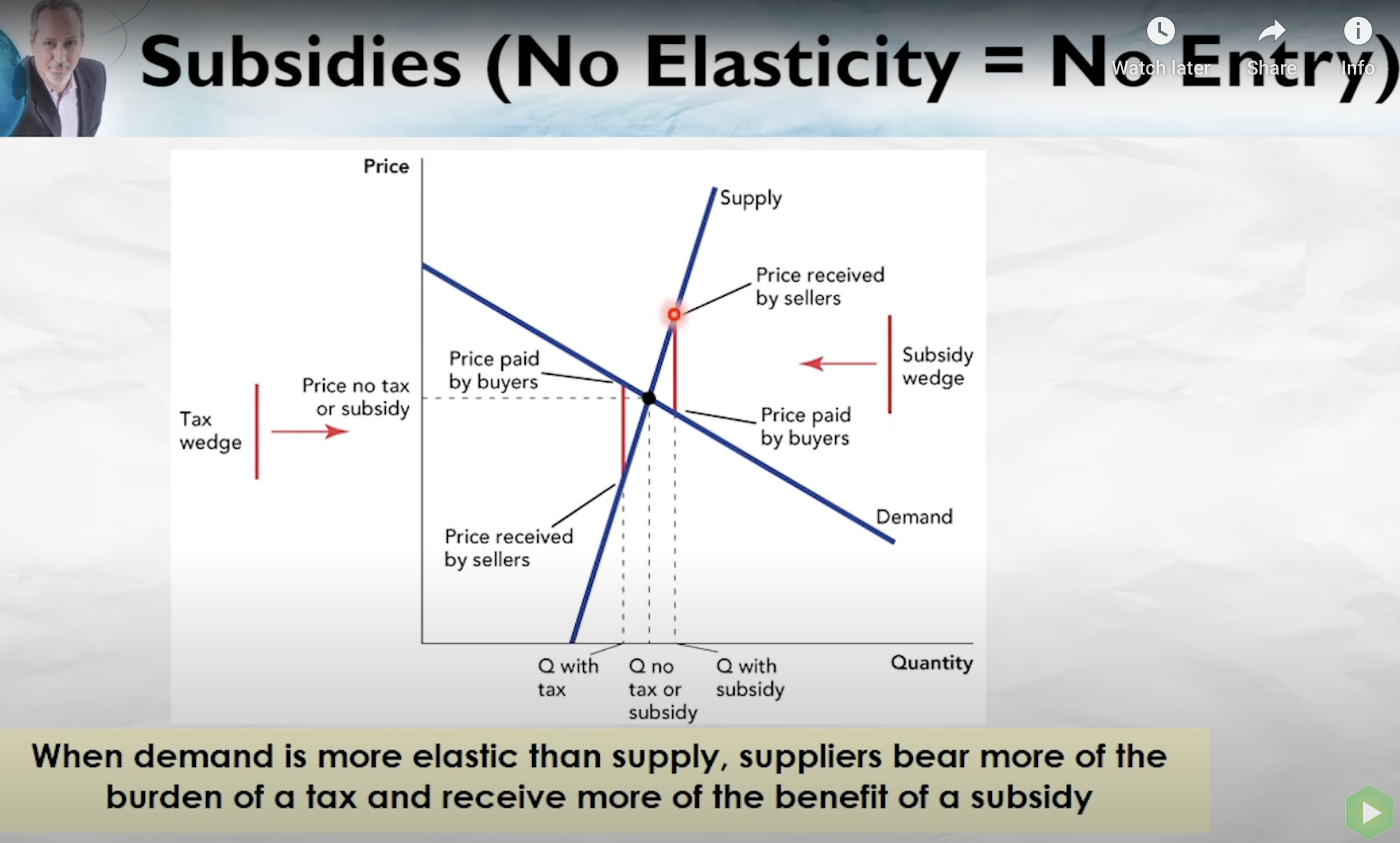

A subsidy is a reverse tax where the government gives money to consumers (or producers)

Just reverse everything you learnt about taxes

- The subsidy wedge is driven into the supply demand chart from the right

No elasticity = no entry

Q. Farmers in Cali’s Central Valley pay $20-$30 an acre-foot for water that costs $200-$500 an acre-foot (via subsidies). Who benefits most, California buyers or suppliers? California suppliers. Supply of resources to grow cotton in Cali is pretty inelastic since there is only so much land. Buyers have an elastic demand because they can get cotton from anywhere else

Q. Some people with diabetes absolutely need to take insulin on a regular basis to survive. Pharmaceutical companies that make insulin could find a lot of other ways to make some money. If the U.S. government imposes a tax on insulin producers of $10 per cubic centimeter of insulin, payable every month to the U.S. Treasury, who will bear most of the burden of the tax?

People with diabetes

Q. Suppose instead that because of government corruption, the insulin manufacturers convince the U.S. government to pay the insulin makers $10 per cubic centimeter of insulin, payable every month from the U.S. Treasury. Who will get most of the benefit of this subsidy?

People with diabetes

The Price System

A price is a singal wrapped up in an incentive

- When oil prices go up, it signals that oil is scarce and incentivizes people to economize on oil usage or develop substitutes

Markets coordinate self interests of different people to produce extensive cooperation and mutual gain #deep-lesson-in-economics

Great economic problem: How to arrange our limited resources to satisfy as many of our wants as possible Resources are not equally valuable in all uses

- If the supply of oil falls, oil should shift to higher valued uses. How?

- Central planner

- Price system

Central planning: a single official or bureaucracy is responsible for allocating limited resources (this is what happened in communist countries)

- Has 2 significant problems:

- Too much information to process: even with all the compute in the world, there are too many microdecisions that will end up causing inefficient allocation

- Too few incentives: Everyone thinks their use is the best use

The market solves:

- The information problem by collapsoing all the relevant information into a single number: the market price

“A price is a signal wrapped up in an incentive”

- An increase in the price of oil signals to users of oil that oil has become more valuable in other uses

- The higher price also gives users of oil an incentive to respond to the signal

- by using less

- substituting

- suppliers are also incentivized by the signal:

- to look for alternatives

- to invest more in exploration

Markets are linked

- geographically

- across different goods

- through time

The market acts like a giant computer that arranges limited resources over space, time and across different goods to satisgy as many of our wants as possible Prices are the signals that coordinate this economic activity

Speculation moves goods from places of low value to places of higher value

In order to speculate on a market of a good (say oil), you don’t have to a have a storage tank to store your oil. You can do it another way; through the futures market.

Futures are contracts to buy or sell specified quantities of a commodity or financial instrument at a specified time in the future at a price agreed on today. e.g. Tyler thinks the price of oil will be more than $50 in 12 months, Alex thinks the price of oil will be less than $50 in 12 months. Tyler agrees to buy from Alex 1000 barrels of oil at an agreed price of $50 per barrel. This is a futures contract

Suppose 12 months from now the price of oil is $82, called the “spot price”. Tyler has 2 options:

- Accept the oil from Alex, pay $50,000 then sell the oil for $82,000. Net $32,000

- But perhaps Tyler doesn’t want to have to find buyers

- Alex gives $32,000 to Tyler and closes contract in cash In practice, futures contracts are always settled in cash

Q. In 1980, University of Maryland, Julian Simon bet Stanford entomologist Paul Ehrlich that the price of any five metals of Ehrlich’s choosing would fall over 10 years. Ehrlich believed that resources would become scarcer over time as the population grew, while Simon believed that people would find good substitutes, just as earlier people developed iron as a substitute for scarce bronze. The price of all five metals that Ehrlich chose (nickel, tin, tungsten, chromium, and copper) fell over the next 10 years and Simon won the bet. Ehrlich, an honorable man, sent a check in the appropriate amount to Simon. What does the falling price tell us about the relative scarcity of these metals?

A. The falling price indicates that the metals are less scarce than what they were before.

Q. Choose the pair that best expresses a relationship similar to that in the original pair. Arbitrager: Region ::

A. Speculator: Time

Prices are signals that convey information: Look to prices to make predictions:

- To help predict Florida weather, look to the price of orange juice in the futures market

- To help predict Middle East politics, look to the price of oil futures

- To predict the consequences of global climate change, look to the price of flood insurance of coastal regions These markets are noisy though (there is a lot of non-useful information that goes into this price)

Prediction market is a speculative market designed so prices can be interpreted as probabilities and used to make predictions

- They are accurate because people are putting real money on the line

- They aggregate a lot of information in a single key feature: the price

Q. You manage a department store in Florida, and one winter you read in the newspaper that orange juice futures have fallen dramatically in price. Should your store stock up on more sweaters than usual, or should your store stock up on more Bermuda shorts? A. Bermuda shorts Orange juice futures falling dramatically signals an increase in supply (bumper harvest), which only happens when the weather is really good (sunny and warm)

Q. Andy enters in a futures contract allowing him to sell 5,000 troy ounces of gold at $1,000 per ounce in 36 months. After that time passes, the market price of gold is $950 per troy ounce. How much did Andy make or lose? A. Andy made $250,000. He can buy and sell it all at the same time and make a profit

Q. If a nation’s government made it impossible for inefficient firms to fail by giving them loans, cash grants, and other bailouts to stay in business, is that nation likely to be poorer or richer as a result of this strategy? (Hint: Steven Davis and John Haltiwanger. 1999. “Gross Job Flows.” In Handbook of Labor Economics (Amsterdam: North–Holland) found than in the United States, 60% of the increase in U.S. manufacturing efficiency was caused by people moving from weak firms to strong firms.) A. Poorer. Keeping the underperforming firms active would prevent talent from moving to stronger firms thus decreasing overall productivity

Price ceilings and floors

Price ceilings

Price ceiling is a maximum price allowed by law. It has 5 important effects:

- Shortages: you can represent this from the supply demand curve

- Reductions in product quality: when there’s more people competing for a good/service, sellers have less of an incentive to make it high quality

- Wasteful lines and other search costs: buyers will be willing to wait in line for the good (i.e. in gas stations). People will only be willing to stay in line as long as the total price (money they pay/price ceiling + the time price) is less than their willingness to pay. Competition does not go away in light of price ceilings. In stead of bidding up the price of the good, the time price is bid up via long and wasteful lines.

- A loss in gains from trade (deadweight loss)

- A misallocation of resources: Price controls will prevent the highest value uses from outbidding lower value uses, resulting in goods of lower value uses being supplied more than higher value uses i.e. when a price ceiling is put on oil, producers will start producing more rubber duckies, instead of supplying jet fuel.

Q. If a government decides to make health insurance affordable by requiring all health insurance companies to cut their prices by 30%, what will probably happen to the number of people covered by health insurance? A. Fewer people will be covered because health insurance companies will supply less.

What is a better form of competition? Pay in money or time? Money. When you pay in money, the money goes to the seller so at least they gain some value When you pay in time, it does not go to anyone. It’s just wasted

Rent controls are a form of price ceilings

- Landlords (or prospective ones) build less

- They reduce housing quality

- Owners respond to price control by cutting costs

- When rent controls are strong

- Serviceable apartment buildings turn into slums (abandoned and hollowed out buildings)

- Finding an apartment often involves a costly search

- Rent controls reduce the price of discrimination

- Bribes can be disguised (charging extra for a “furnished” apartment)

- Apartments are not allocated to the renters who value them the most

- People keep apartments even when they don’t need them because its so cheap to them (you get a 5-bd house when you only need 1-bd)

Rent controls often appear attractive to renters but extensive rent controls can cause cities to crumble

- In Mumbai for example, 15% of Mumbai housing is empty because landlords don’t want to risk having a tenant they can’t evict

- Low rent means landlords may not take in enough revenue to fund repairs

Low rents don’t necessarily incentivize migration to the cities that have implemented controls

What the price ceiling does: A price ceiling is a legally enforced maximum price — set below equilibrium price in this case.

- This lowers the price producers receive.

- As a result, quantity supplied falls, while quantity demanded increases, creating a shortage.

- Only a smaller number of trades (i.e. units) take place — less than what would happen at equilibrium.

Why there’s deadweight loss: The triangle labeled “Deadweight loss” shows the lost trades between the new lower quantity (due to price ceiling) and the original equilibrium quantity.

- These are trades where buyers were willing to pay more than the sellers’ cost, but the trade doesn’t happen because of the ceiling.

- No one gains that lost value — it’s not captured by consumers or producers.

- That’s why it’s called deadweight — it’s value lost to society due to inefficiency.

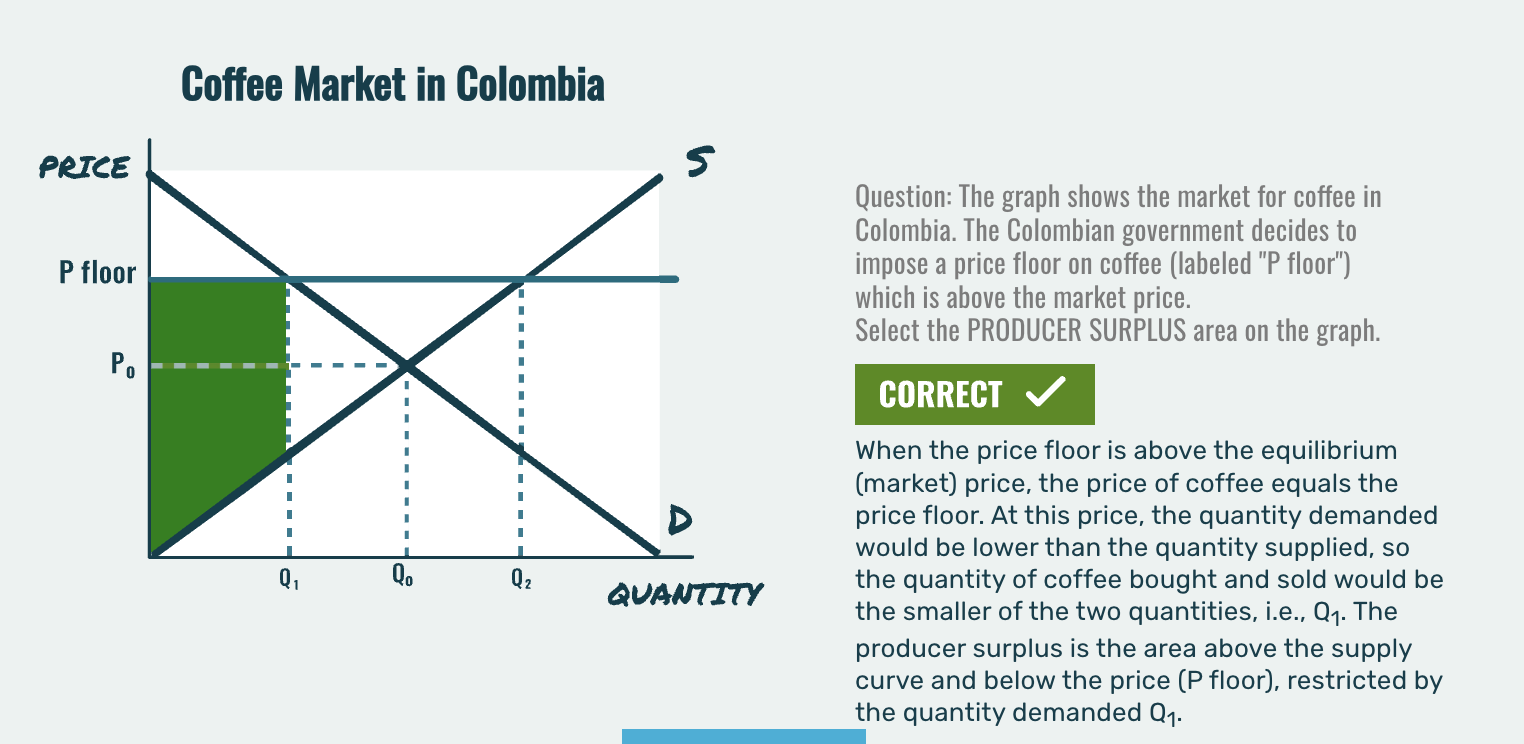

Price floors

Price floor is a minimum price allowed by law They create:

- Surpluses: unemployment

- Lost gains from trade (deadweight loss): there are workers willing to work for less and companies willing to pay them less

- Wasteful increases in quality: If sellers cant compete by lowering the price, they increase quality

- Misallocation of resources

Price floors are less common than price ceilings because there are typically more buyers than sellers. You can see this as a political reason: you are benefiting the masses

Workers with very low productivity are most affected by the minimum wage

- Least experienced

- Least educated or trained

Minimum wage creates a surplus of labour (unemployment)

At best, the minimum wage raised the wages of some low skill and young workers, most of whose wages would have increased anyway as they became more skilled

At worst, the minimum wage will increase the price of a hamburger and create some unemployment or keep teenagers in school longer

Producer surplus for price floor higher than free market equilibrium

Producer surplus for price floor higher than free market equilibrium

Do price controls help the poor? Not really For example: Rent controls help people who have rent-controlled apartments but make it more difficult to get an apartment

- Many people with rent controlled apartments are not poor Minimum wages help workers who keep their jobs at the higher wage but not those who can’t find a job

- Many people with minimum wage jobs are not truly poor (students who live at home with their parents) Often there are better ways to help the poor

- housing vouchers

- wage subsidies

Economists believe that we should help the poor by doing it in a way that is consistent with markets and works alongside markets rather than trying to override markets

Q. If a government decided to impose price controls on gasoline, what could it do to avoid the time wasted waiting in lines? Though there are several solutions to this problem, only one of the options below is correct. A. Create gasoline rations

Communism, a command economy, can be thought of as a system of universal price controls e.g. In Soviet countries

- Some goods were in shortage and others in surplus

- it was common to have every part to produce a good (radio) except 1

- women waited ~2 hours everyday to buy goods

Substitution of “planned” chaos for market coordination

Trade

3 benefits of trade:

- Trade makes people better off when preferences differ

- Trade increases productivity through specialization and the division of knowledge: more specialization -> increased knowledge -> increased productivity. If you had to tailor your own clothes, grow your own food etc. you’d be miserable

- Trade increases productivity through specialization according to comparative advantage

One of the reasons developing economies are poor is because they are less specialized, which means there is a reduced level of knowledge and brain power

- i.e. in Vietnam, 60% of the population are farmers, which means they all know a lot about food, but not much else

- the brain power is not being used to its fullest extent

Why is globalization is good? The world as a whole can become specialized and therefore world knowledge increases.

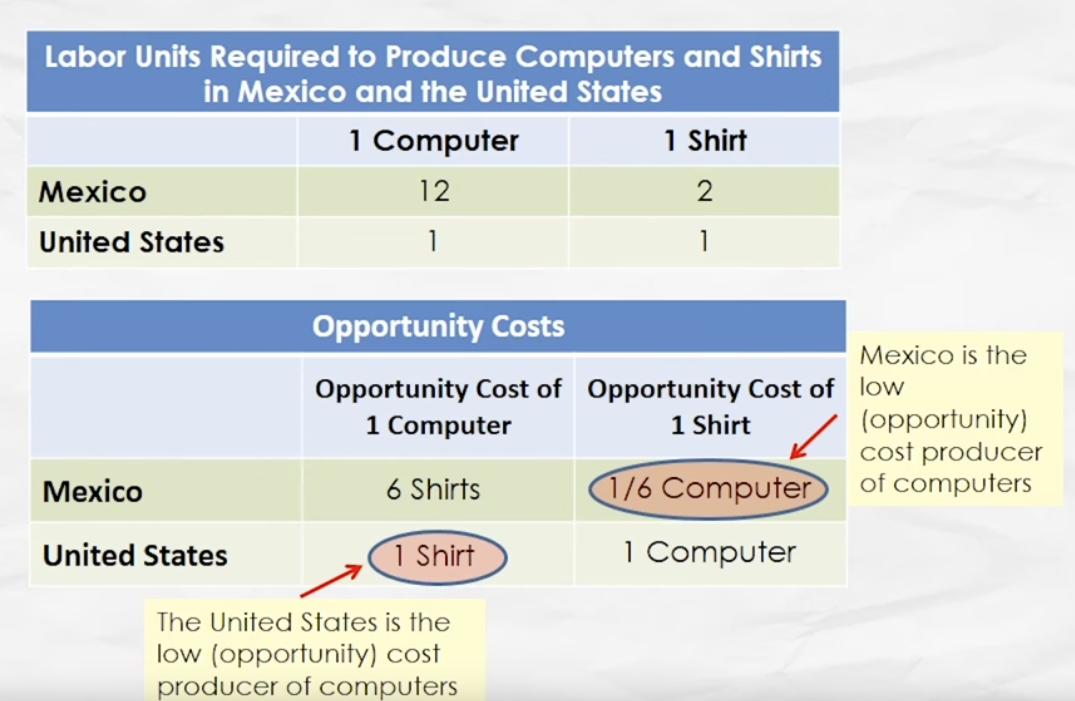

Comparative advantage, a core economic principle, suggests that individuals, businesses, or countries can benefit from trade by specializing in producing goods or services where they have a lower opportunity cost, even if they are not the absolute best at producing everything.

- Just by re-arranging tasks, there is a total increase in production. You don’t need to improve your skills to get these benefits

- The more different 2 parties are, the more they benefit from each other

Comparative advantage applies to people, groups and countries. It is also known as the law of association

Diversity is strength when combined with trade

Absolute Advantage: A country, company, or individual has an absolute advantage if they can produce more of a good or service using the same amount of resources compared to another. For example, if Country A can produce 100 units of a product with the same resources that Country B needs to produce 80 units, then Country A has an absolute advantage in producing that good.

Absolute advantage explains which countries in the world are rich, but comparative advantage explains why it makes sense to trade and what goods make sense to trade

Q. Data can write 12 excellent poems per day or solve 100 difficult physics problems per day. Riker can write one excellent poem per day or solve 0.5 difficult physics problems per day. * A.

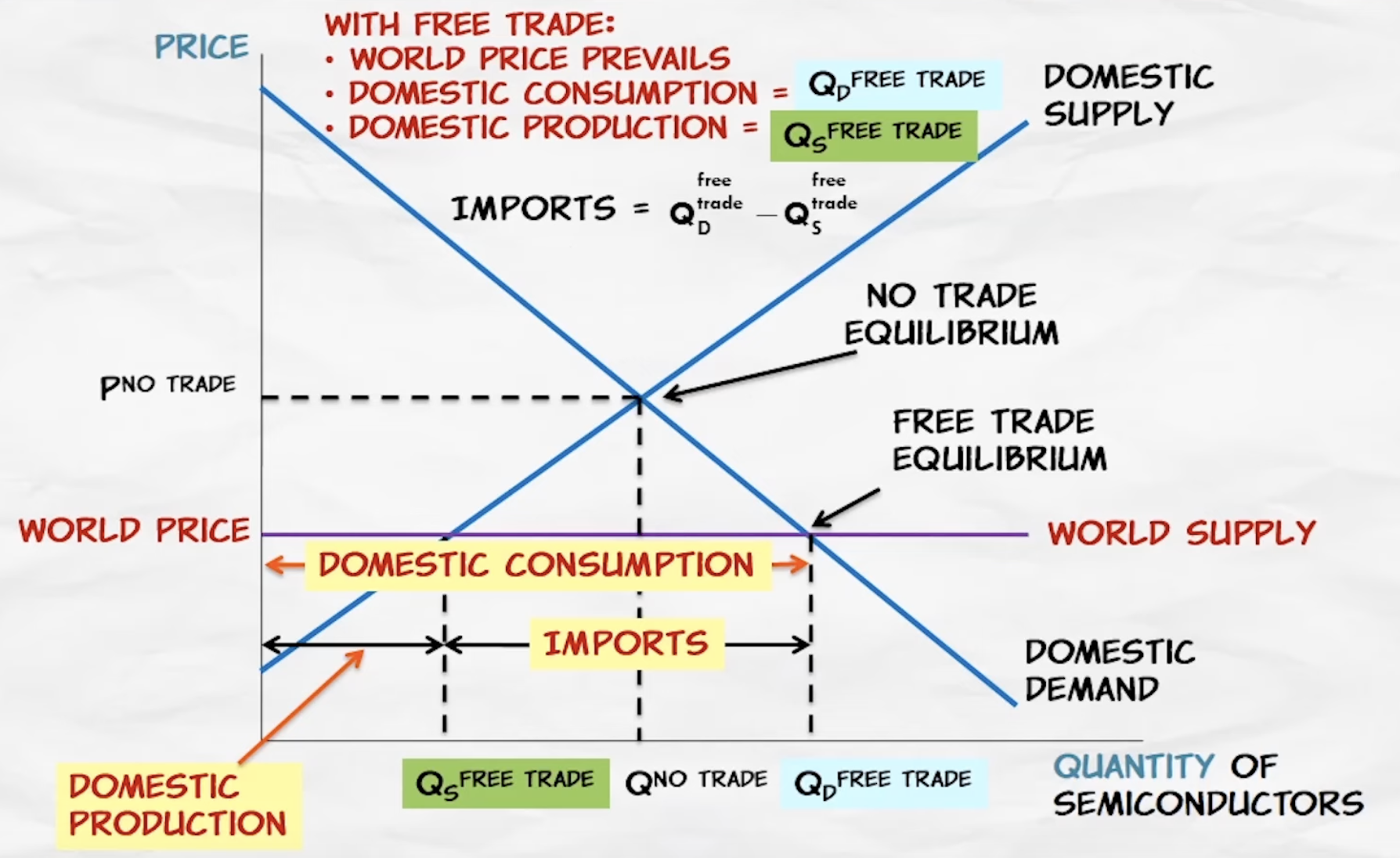

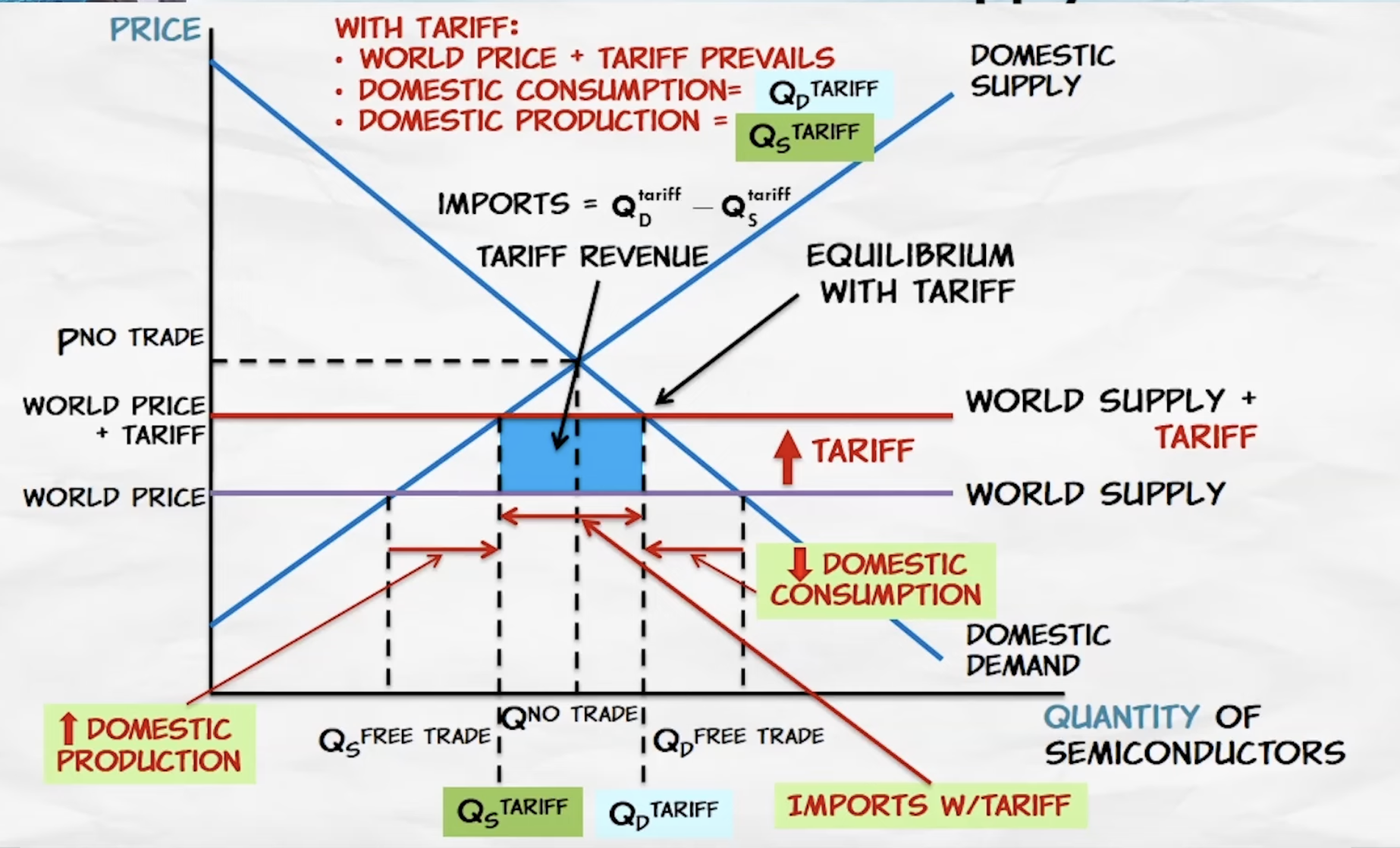

Protectionism: the economic policy of restraining trade through tariffs, quotas or other regulations that burden foreign producers but not domestic producers

Tariff: a tax on imports

Quota: restriction on the quantity of goods that can be imported

Tariffs reduce welfare by:

- Domestic consumption decreases because of lost gains from trade

- Domestic production increases because of wasted resources from higher-cost production (Tariffs divert production from low cost producers (world) to high cost (domestic) producers)

Distribution of losses and gains:

- Bad for consumers

- Good for domestic producers

- Bad overall

Arguments against international trade and why they’re wrong:

- Child labour. Child labour happens in poor countries. Not trading with poor countries will make the families even poorer, which results in more child labour

- Some industries should be protected to protect national security. Subject to great abuse– almost every industry can make this argument for protection

- It makes sense for stuff like vaccine production

- It doesn’t make sense for angora goat fleece though (since they are used to make military clothes, they are not exported)

- Key industries that create spillovers like tech (so that a country can have a foothold in that industry). Not a compelling argument since most computer chips are cheap, mass produced products. A better model is to do the chip design in the US and then manufacture them in a cheaper place like Taiwan. Also, no one really knows which industries will cause spillovers (i.e. in 1990 Walmart contributed more to the boom in productivity than Silicon valley)

- Strategic trade protectionism (Using tariffs and quotas to get a larger share of gains from trade) by limiting or taxing exports; allowing domestic firms to act as cartels when selling to international buyers.

- Could be effective for goods with few substitutes

- Not a great idea if other countries can retaliate; then world trade will shrink and no country will be better off.

Free trade is a robust policy (works well in most cases)

The levels of globalization:

- The village: Goods and information were local (came from people in their village/town) because transport was dangerous and trade was limited

- World trade: Cheap and fast transportation of goods allowed goods to move globally. Every part of a good (e.g. a car) was made in one location (a huge factory)

- Information revolution: Came from cheap and fast communication (PCs, internet, mobile phones). You can consume info from all over the world

- (not yet unlocked) Virtual presence revolution: Teleoperation (surgeries done on a patient in France by a doctor in NY– this has already happened), Security guard in India watching over a store in Canada, Holograms.

Externalities

Bystanders are neither buying or selling but are affected by the purchase and use of a good (e.g. antibiotics) Negative Externalities are when bystanders bear a cost

Antibiotics cause negative externalities for bystanders: users of drugs make certain antibodies resistant to regular antibiotics, and then when those antibodies (now called superbugs) spread, there are no cures for it because they have developed a resistance

Positive Externalities are when bystanders receive a benefit (e.g. getting a flu shot helps everyone around you because it limits the spread of the virus)

Social surplus = Consumer surplus + producer surplus + bystander surplus

Command and control is when the government says you can do X and not X (e.g. you cannot sell a washing machine that uses Y Watts so that we can conserve electricity) These are rarely efficient

- There are many ways to achieve most goals (reduce electricity use in the ways that are least costly/valuable)

- The government may not have enough information to order the least cost method

A better method of (say conserving electricity) is to impose a tax on usage:

- A tax on electricity would allow users flexibility to find the lowest cost ways to reduce their use of electricity

- Few people would choose to pay a lot more for a washer that doesn’t clean well

The goal is to reduce pollution; not necessarily use less electricity

- That’s why Pigouvian tax works quite well

Command and control can be a good solution when ;

- The best approach to the problem is well known

- success requires very strong compliance i.e. when flexibility is not a good thing A good example is the eradication of smallpox

Q. Suppose that whales are threatened with extinction because a large number of people like to eat whale meat. Governments are torn between banning all whaling except for certain religious ceremonies, and heavily taxing all whale meat. Assume there are only a few countries in the world who consume whale meat, and that they have fairly efficient governments.

A. Ban the eating of whale meat.

Coase theorem: If transaction costs are low and property rights are clearly defined, private bargains will ensure that the market equilibrium is efficient even if there are externalities.

- The market can be efficient even when there are externalities when:

- the costs are low

- property rights are clearly defined

A a good explanation from Reddit: *“Simplified, the Coase theorem basically says: If property rights are established, known and enforceable, and both sides can negotiate costlessly, then an efficient outcome can be reached. And it doesn’t matter who has the property rights as long as they’re defined. (Keep in mind the economic principle that distribution of income has no impact on efficiency.) A common example is a factory polluting a farmer’s field. There are a couple potential outcomes:

- If the factory’s activities generate $100 in profit and the field generates $80 in profit, the efficient outcome is to pollute.

- If the factory owns the property rights, it produces. $100 is created and $80 is lost leading to a net of +$20 which is an efficient outcome.

- If the farmer owns the property rights, the two can negotiate and the factory can pay the farmer $80 to cover damages and then pollute. Again, net +$20, efficient outcome but different distribution.

- If the farm produces $100 and the factory produces $80, the efficient outcome is to farm.

- If the factory owns the property rights, the farmer can pay the factory $80 to not produce, and then farm and earn $100. Again, efficient outcome.

- If the farmer owns the property rights, he can block the factory from producing, causing it to lose $80 while he gains $100. Still efficient outcome.

Since efficiency can be achieves as long as the parties can negotiate and property rights are assigned and enforceable, that’s really as far as you need to go. But, if you want distributional equity, then you can achieve that by who you assign the property rights to. It’s been a decade since I took a law and economics class, so I don’t remember the general rule for assigning property rights, but I think one of the rules of thumb, at least, is that it’s fairest to assign property rights to the party that is harmed so that the harmer pays the harmee to make them whole.”*

Conditions for the Coase theorem may often not be met but even so the theorem does suggest an alternative approach to externalities. The theorem suggests a solution- the creation of new markets. If a government can:

- define property rights

- reduce transaction costs

- … markets can be used to control externality problems

Q. Consider a factory, located in the middle of nowhere, producing a nasty smell. As long as no one is around to experience the unpleasant odor, what type of externality is produced?

A. No externalities

Q. Suppose that a family moves in next door to this smelly factory. Who is causing the externalities problem?

A. Both the factory and the house

Q. In theory, one reason why tradable pollution allowances are preferable to pollution regulation is because they: A. Encourage lowest-cost pollution reduction.

Important result of sulphur dioxide trading program:

- Firms that generate electricity from clean sources make money by selling allowances

- Firms that generate electricity from dirty sources must buy allowances The result is:

- clean energy is subsidized, but not by taxpayers

- dirty energy is taxed Tradable permits allow environmental groups to reduce pollution.

- They do this by buying permits to produce X amount of sulphur dioxide and then they tear those permits up. This way, no one can produce that into the environment. The lower the cost of solving a problem, the more likely we are to solve that problem

Q. A government is torn between selling annual pollution allowances and setting an annual pollution tax. Unlike in the messy real world, this government is quite certain that it can achieve the same price and quantity either way. It wants to choose the method that will pull in more government tax revenue. Which method is better from a revenue-raising perspective? A. Revenues will be the same.

Q. Maxicon is opening a new coal-fired power plant, but the government wants to keep pollution down using tradable pollution permits. If a corrupt government just grants Maxicon all of the pollution permits in the entire nation (even though there are many energy companies), what do we predict will happen to pollution production?

A. The firms polluting will likely be those with the highest costs of reducing pollution.

With tradable permits, the initial (even unfair) hand‑out doesn’t change the overall pollution cap. Firms with low abatement pollution costs will sell permits to those with high abatement pollution costs, so the plants that keep emitting are the ones for which cutting pollution would be most expensive.

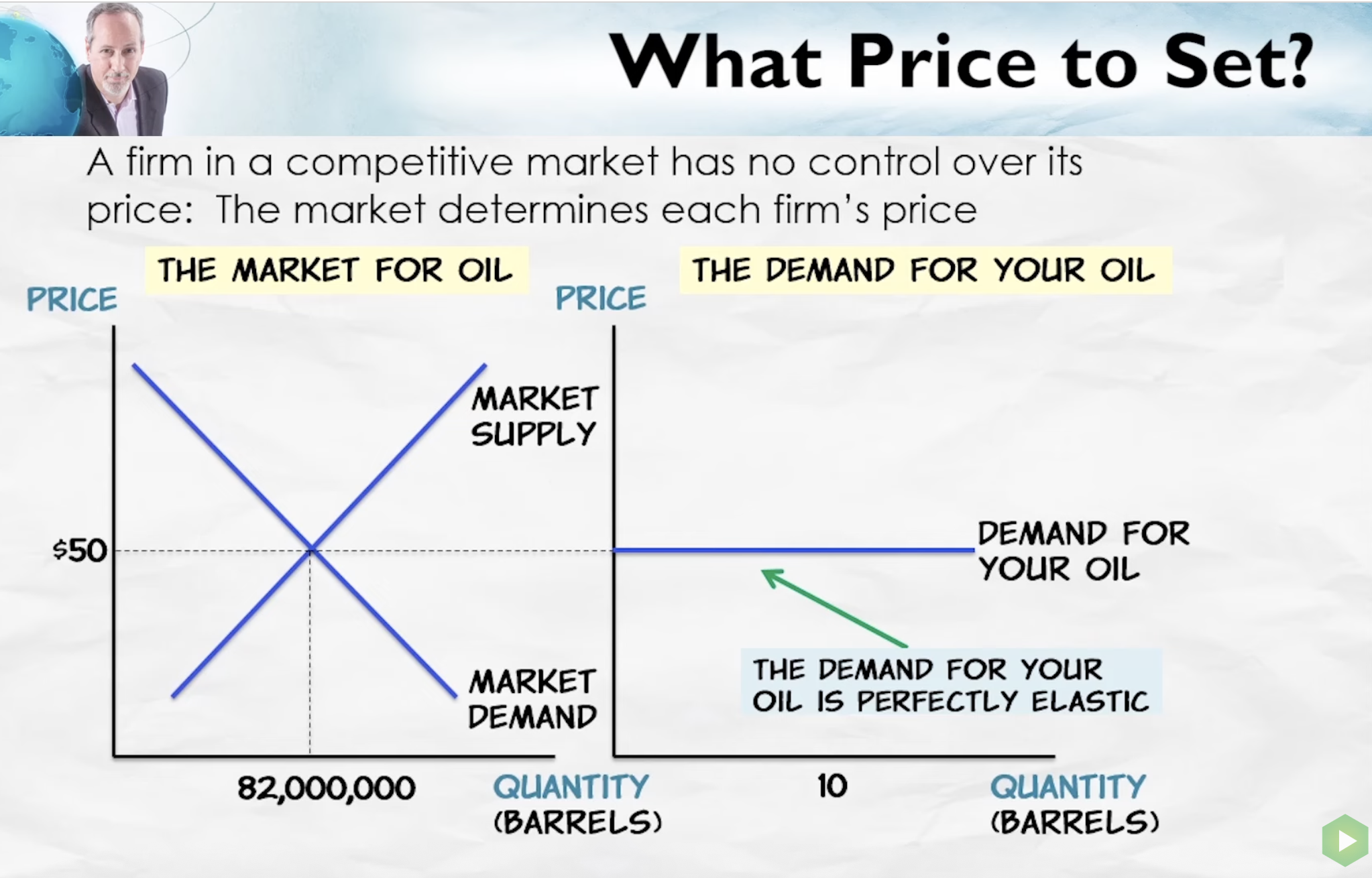

Costs and Profit Maximization Under Competition

Profit is the main motivation for firms’ actions Firms maximize profit by choosing price and quantity:

- some firms have more control over their price than others

- a competitive firm takes prices as given and chooses quantity

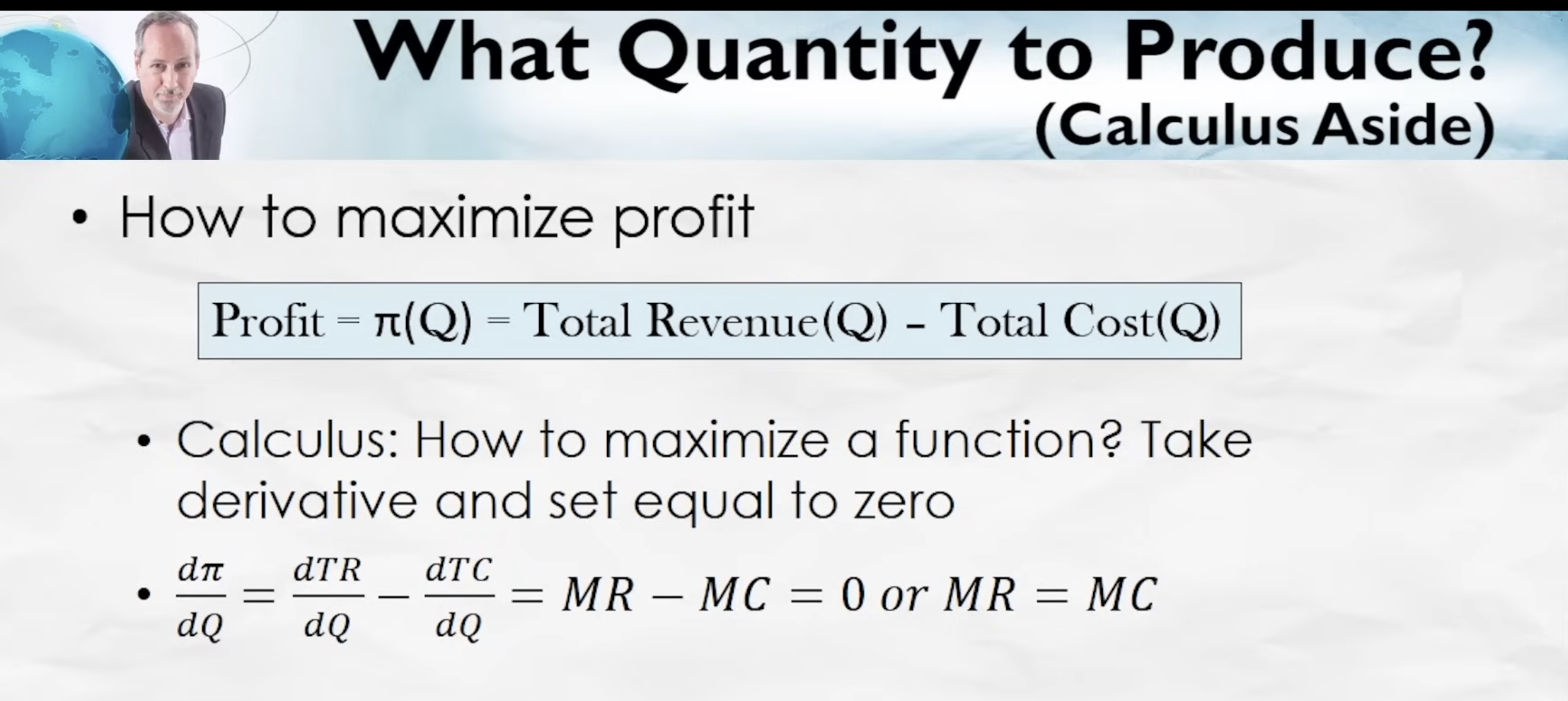

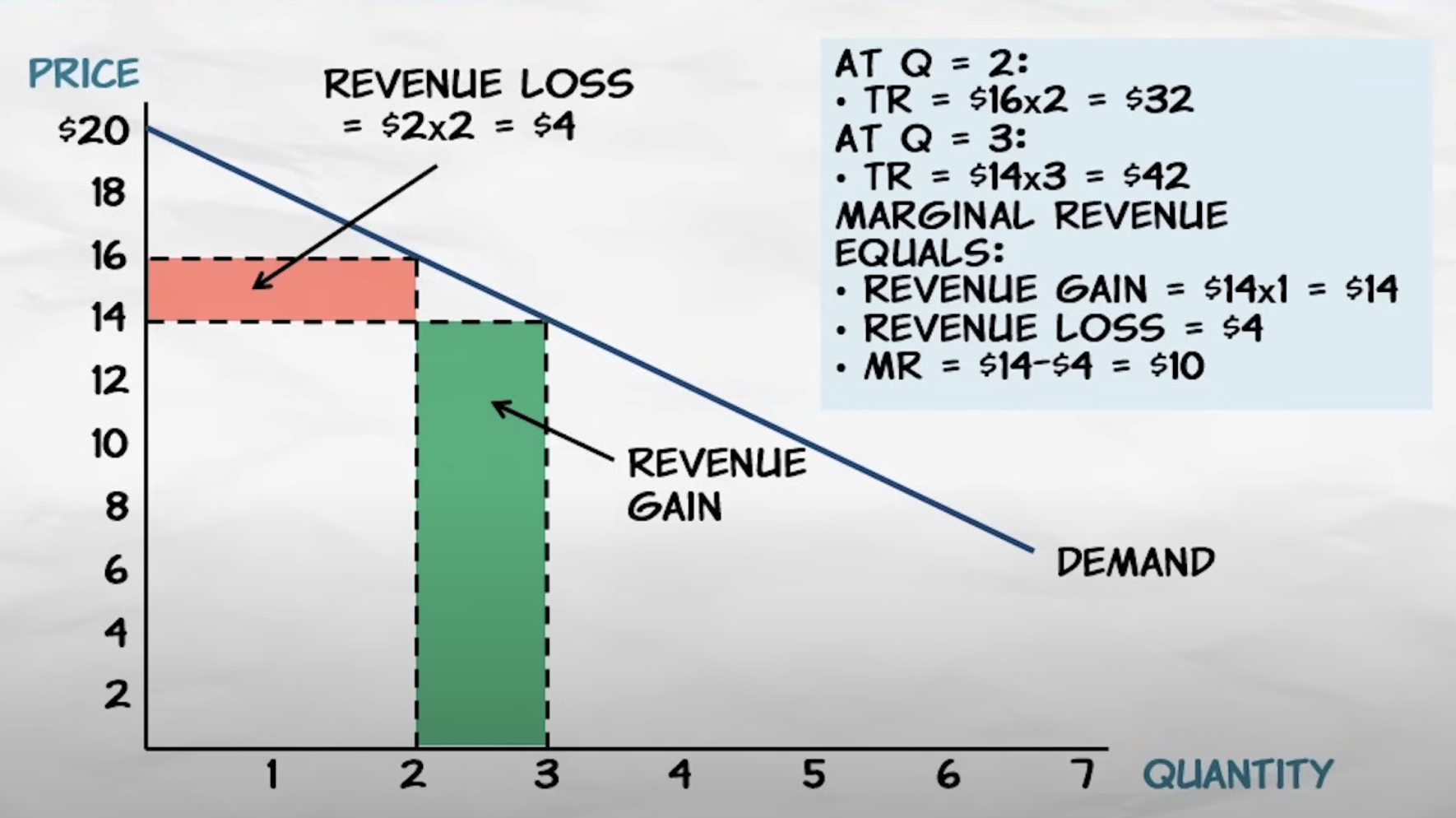

dTR (derivative of Total Revenue) = MR (marginal revenue)

dTC (derivative of Total Cost) = MC (marginal cost)

dTR (derivative of Total Revenue) = MR (marginal revenue)

dTC (derivative of Total Cost) = MC (marginal cost)

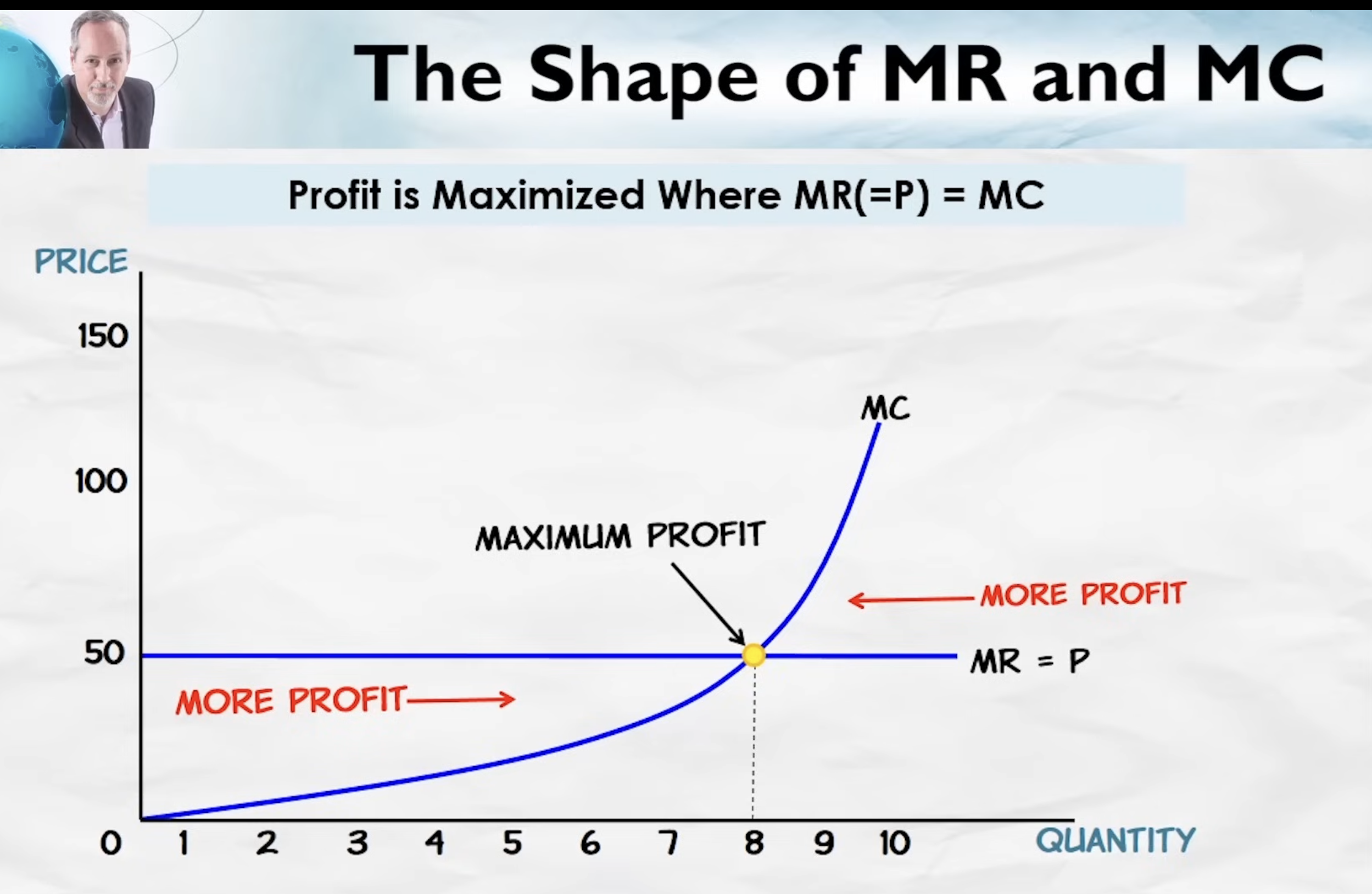

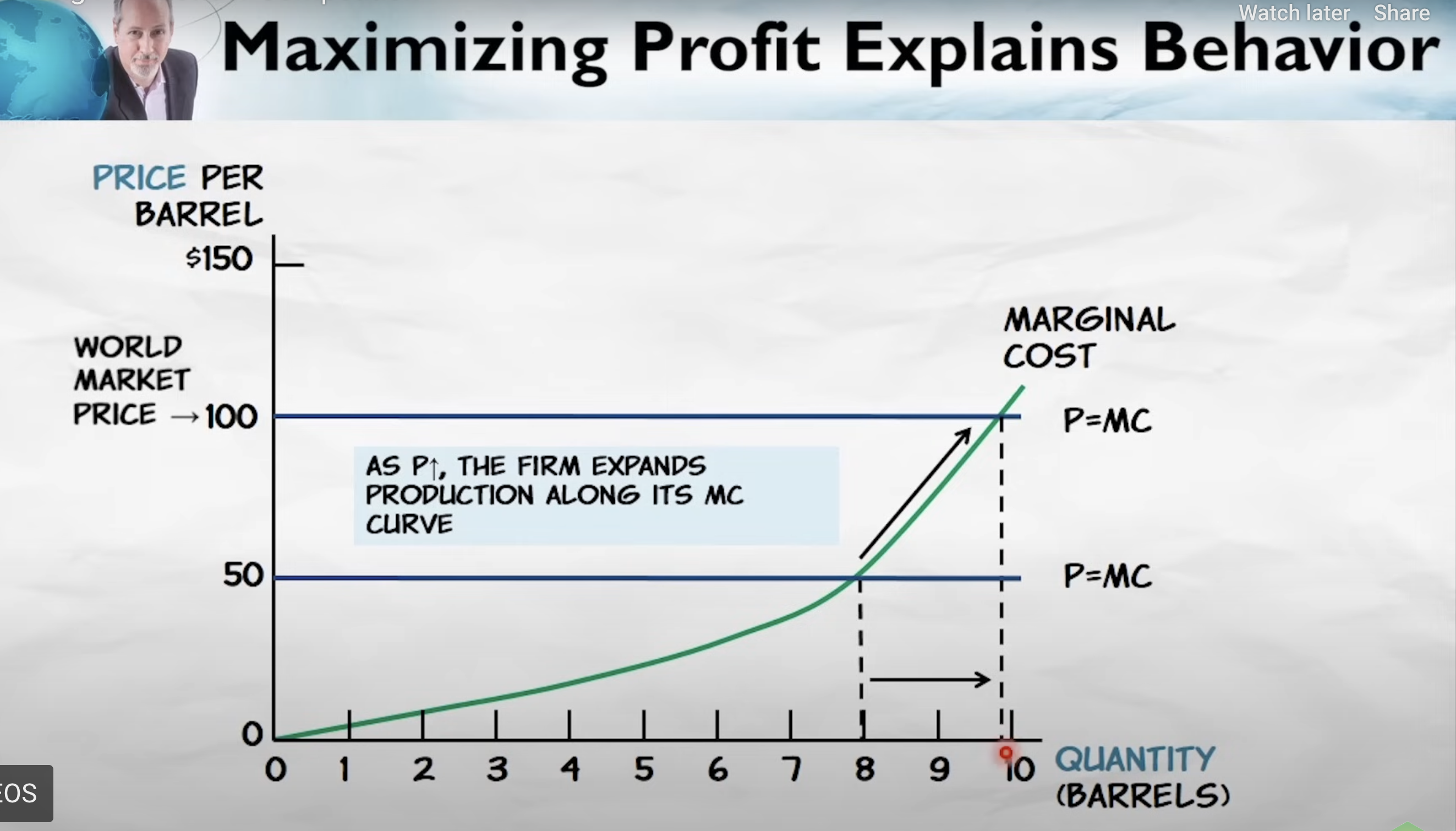

If MR > MC, you are not profit maximizing because you’d be leaving money on the table. If the cost to make an additional unit is less than the additional revenue that unit would yield, then you want to keep making more of that unit until MR = MC. Past that point, MC > MR and it starts costing more to make an additional unit that what that unit will bring in in revenue.

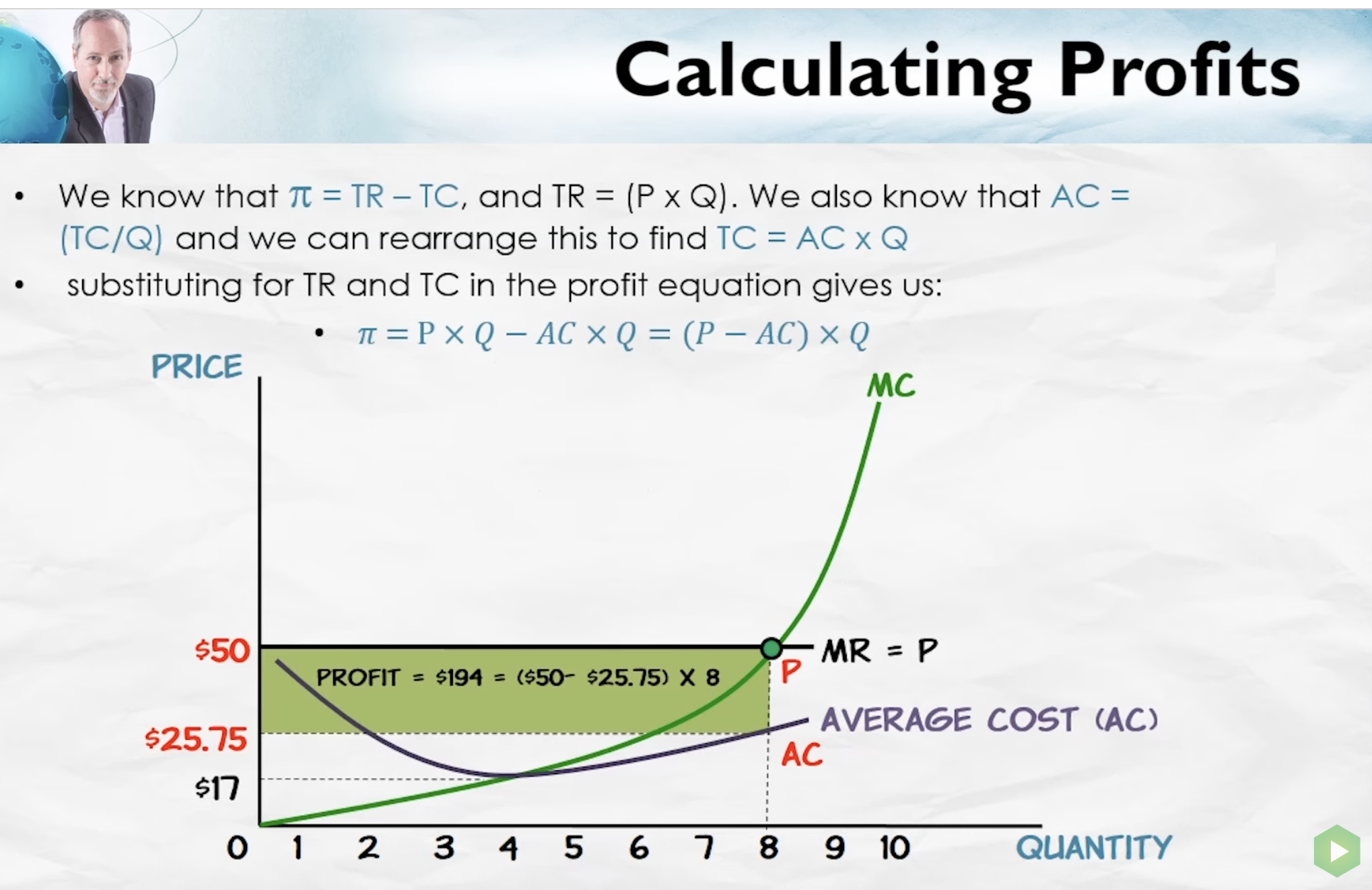

Average cost is the cost per unit of output. AC = TC / Q

Q. The economic definition of profit differs from the accounting definition of profit in that the economic definition includes opportunity costs

Q. A competitive firm maximizes profit by choosing a level of output where the world price is equal to the firm’s marginal revenue

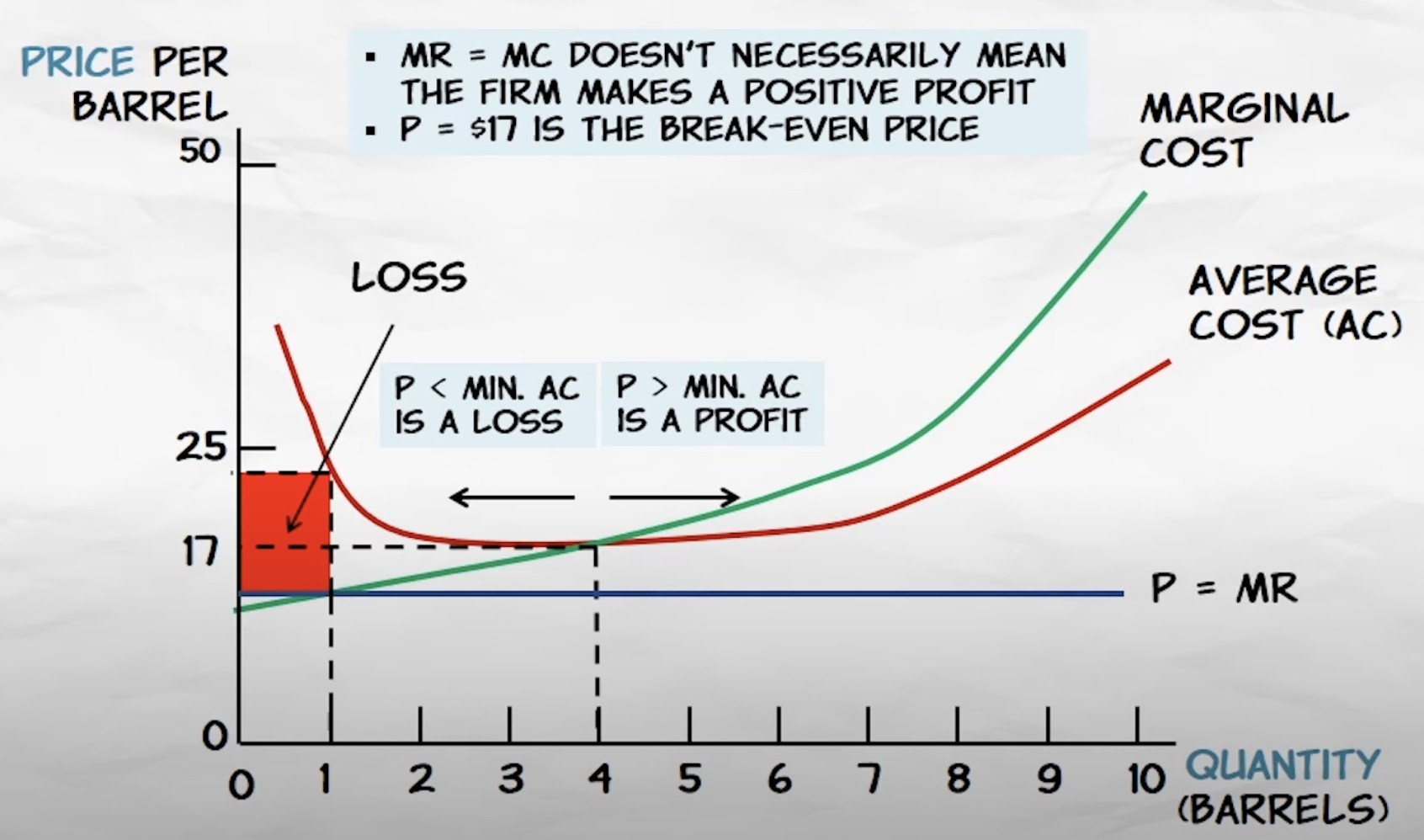

Even if profit is negative, if revenues are greater than variable costs, then it’s best to stay open in the short run.

Maximizing profit and the average cost curve

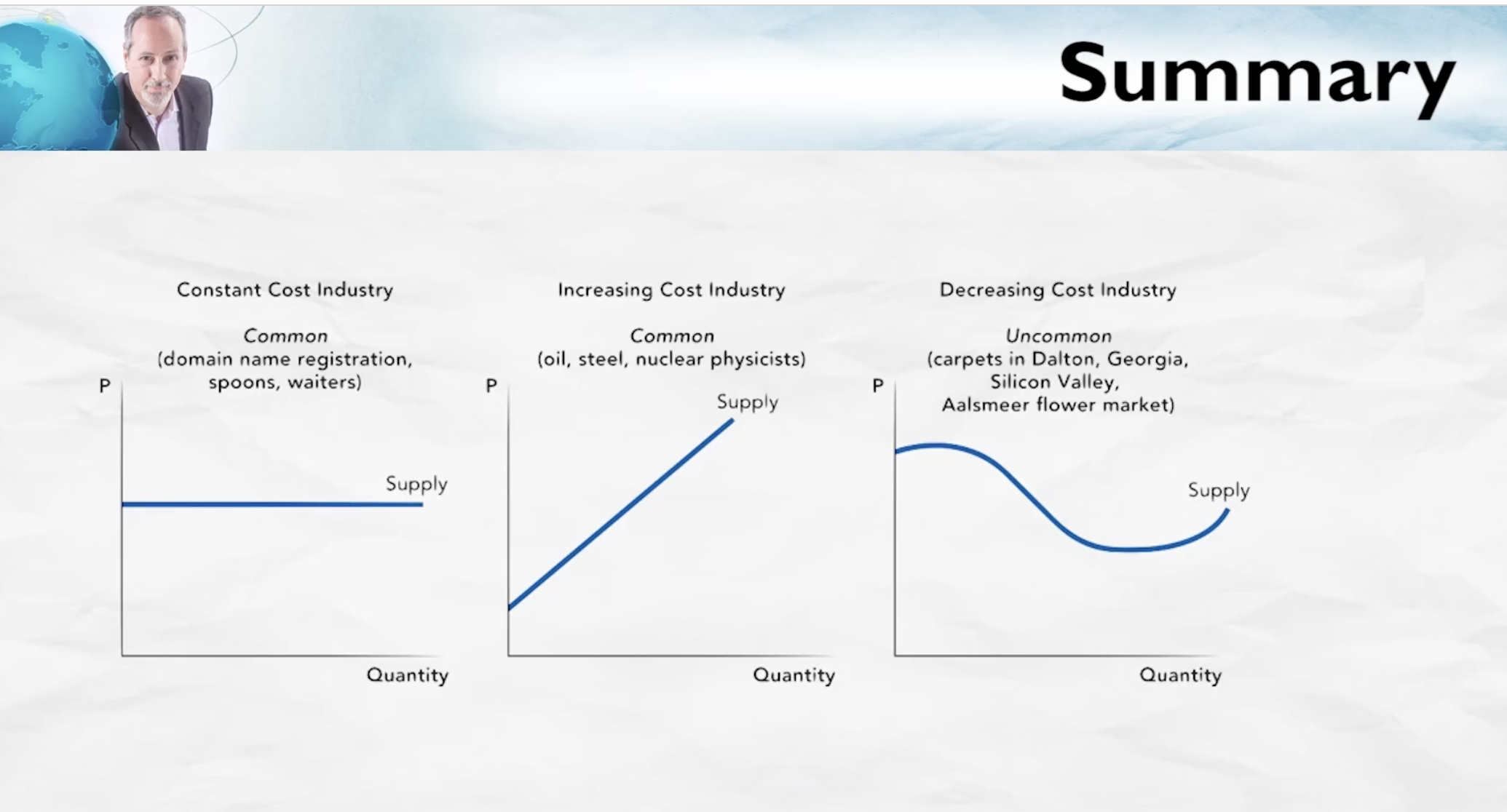

Entry, Exit and Supply Curves: Increasing costs

Any industry where it is difficult to exactly duplicate inputs e.g.

- Oil

- copper, gold, silver

- coffee

- nuclear engineers

Any industry that buys the large fraction of t the output of an increasing cost industry will also be an increasing cost industry e.g.

- gasoline industry: pushes up demand for gas -> pushes up price of oil -> pushes up price of gas

- electricity: pushes up demand -> pushes up demand for coal

Q. What is the least common cost structure for an industry? A. Costs decrease as industry output increases.

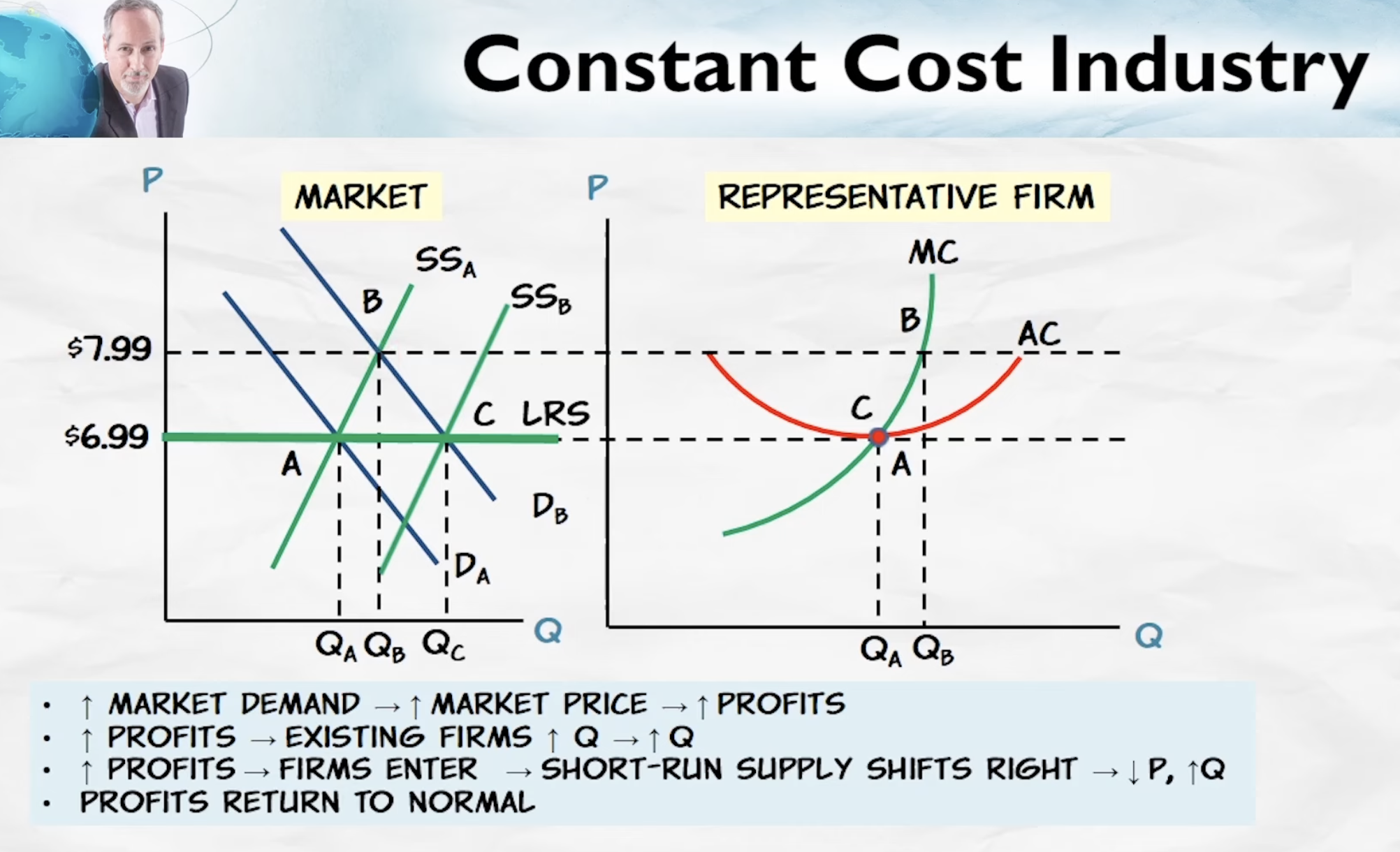

Entry, Exit and Supply Curves: Constant costs

Very easy to expand industry output without raising costs e.g. pencils, rutabagas, domain name registration

Implication: long run supply curve is flat

Q. In the competitive children’s pajama industry, a new government safety regulation raises the average cost of children’s pajamas by $2 per pair. If this is a constant cost industry, then in the long run, what exactly happens to the price of children’s pajamas? A. The price of pajamas increases by exactly $2 In a constant cost industry, long-run supply is perfectly elastic (horizontal). This means any increase in production costs (like a $2 regulatory cost) gets fully passed on to consumers. So, the price increases by exactly $2.

Q. If this is an increasing cost industry instead, will the long-run price of pajamas rise by more than $2 or less? (Hint: The long-run supply curve will be shaped just like an ordinary supply curve. If you treat this like a $2 tax per pair, you’ll get the right answer.) A. The price of pajamas increases by less than $2. In an increasing cost industry, producing more raises the input prices or resource costs. So when a $2 cost is added, firms not only pass on that $2 but also additional costs from increased factor prices. Therefore, price increases by more than $2.

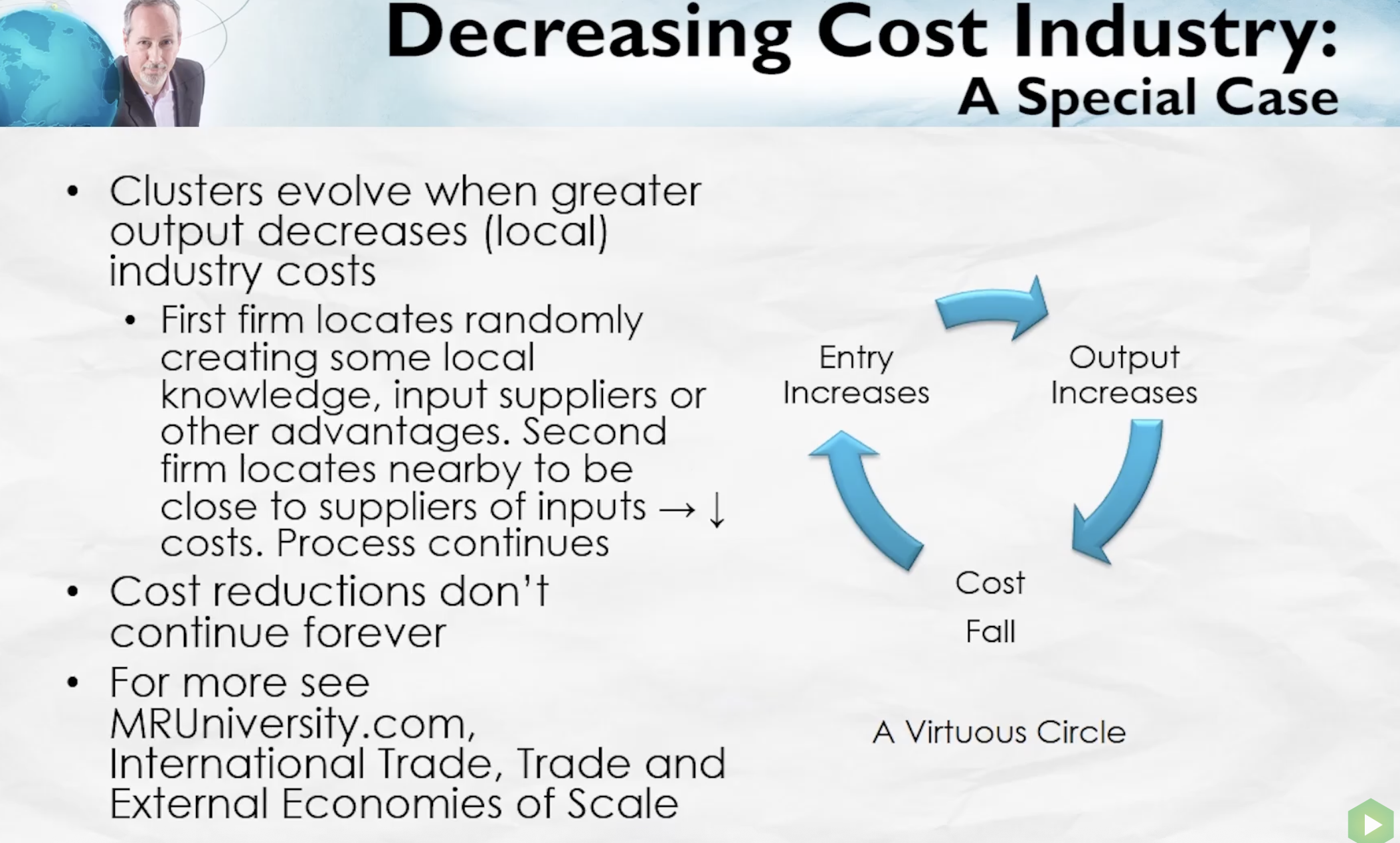

Entry, Exit and Supply Curves: Decreasing costs

Summary

Q. As Ngoy started hiring more Cambodian refugees to work in his donut shop, this made it more likely that

A. Other Cambodians would open donut shops.

Q. At this point in the story, what sort of cost industry (constant, increasing, or decreasing) would you consider doughnut shops owned by Cambodians to be?

A. Decreasing

As more Cambodian-owned shops opened, shared knowledge, labor networks, and community support likely drove down costs (economies of scale and scope), making this a decreasing cost industry.

Q. Fast forward 40 years: What kind of cost structure are Californian doughnut shops probably in now?

A. Constant

Q. We mentioned that carpet manufacturing looks like a decreasing cost industry. In American homes, carpets are much less popular than they were in the 1960s and 1970s, when “wall-to-wall carpeting” was fashionable in homes. Suppose that carpeting became even less popular than it is today: What would this fall in demand probably do to the price of carpet in the long run?

A. Increase carpet prices

Even though it’s a decreasing cost industry, a fall in demand leads to reduced production, which may reverse economies of scale or increase average costs as firms exit the industry.

In the long run, fewer firms and less production mean higher per-unit costs, and thus higher prices — even in a decreasing cost industry.

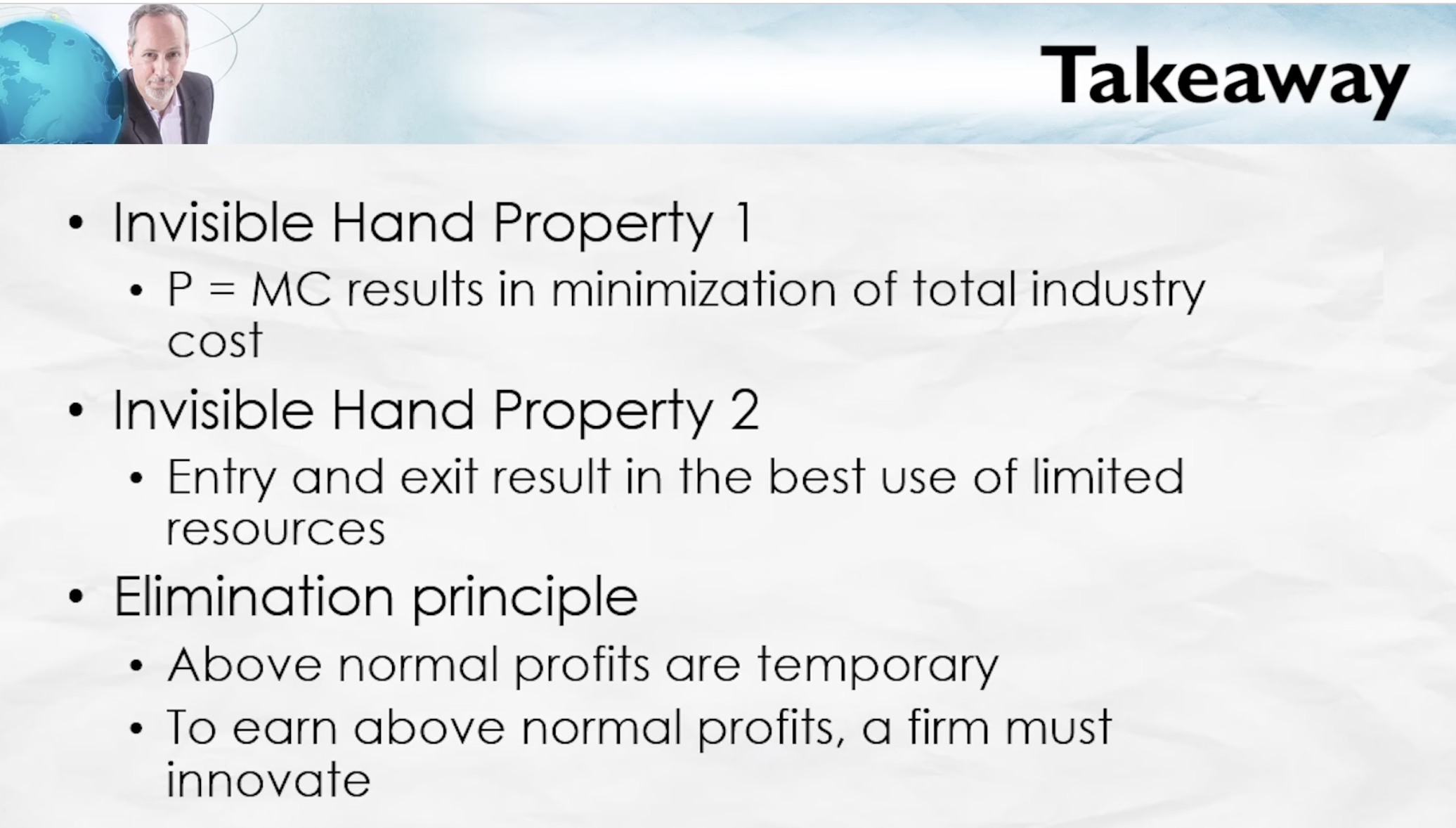

Competition and the Invisible Hand

Minimization of total industry costs of production

Firms maximize profits by:

- producing at the quantity where P = MC

- entering an industry if P > AC; exiting an industry if P < AC

Invisible hand property 1: Competitive markets balance production across firms in an industry so that total industry costs are minimized (for any given quantity of production) In a competitive market with N firms…

- all firms face the same market price

- To maximize profits each firm adjusts its output until P = MC

- This means P = MC1 (MC of firm 1) = MC2 = MCN

- This results in minimizing total costs for the industry

Invisible hand property 2: Entry and exit decisions balance production across different industries so that the total value of production is maximized

Tip: when asked about the total costs, add up the costs of producing every unit until the Nth unit. - The marginal cost is the cost to produce the Nth unit, so if cost to produce N = 1 is $10 and cost to produce N = 2 is $20, the total cost to produce 2 units is $30

The Balance of Industries and Creative Destruction

How much should be produced in each industry? To maximize the value of resources, we want each industry to produce the “right” quantity

- IHP2 makes this happen Entry or exit work to ensure that

- labour and capital move across industries so that production is optimally balanced and the greatest use is made of our limited resources

Profit is the signal that allocates capital and labour across industries in a way that maximizes total value

- If P > AC, profits are above normal. Output in this industry is worth more than inputs. Profit signal says we want more of this good.

- Profit signal and incentivizes capital and labor to enter the industry i.e. move from a low value industry to a high value industry

- If P < AC, profits are below normal. Output in this inudstry is worth less than inputs. Loss signal says we want less of this good.

- Loss signal and incentivizes capital and labor to exit the industry i.e. move from a low value industry to a high value industry Profit rate in all competitive industries tends towards the same level

Creative Destruction

Elimination principle: Above normal profits are eliminated by entry, and below-normal profits are eliminated by exit

- Resources always move toward an increase in the value of production

- Entrepreneurs move resources from unprofitable industries to profitable industries Implication of this principle:

- Above normal profits are temporary

- To earn above-normal profits, entrepreneurs must innovate

The invisible hand will not work if:

- prices do not accurately signal costs and benefits. Result: no optimal balance between industries

- Markets are not competitive. Result: Monopolists and oligopolists earn above normal profit but entry doesn’t occur or too little of the profitable good is produced

Monopoly

Market power: Power to raise price above marginal cost without fear that other firms will enter the market Sources of market power: Selling a unique good with barriers to entry such as:

- patents

- government regulations other than patents

- economies of scale

- exclusive access to an important input

Monopoly truths:

- They have market power: They are the price makers

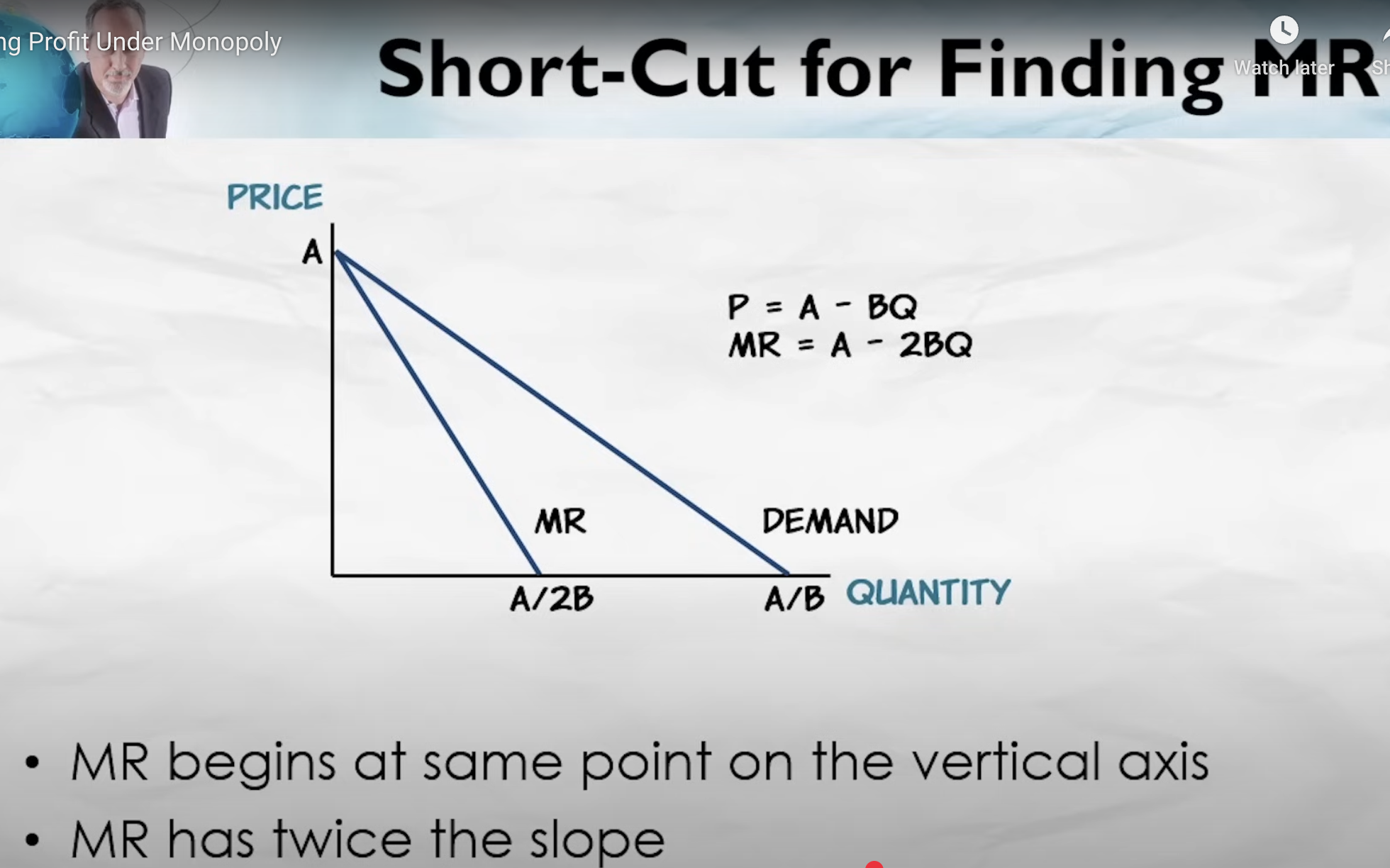

- All firms set MR = MC to find their profit maximizing quantity

- Their marginal revenue is simply no longer the price of the good (as it happens in a )

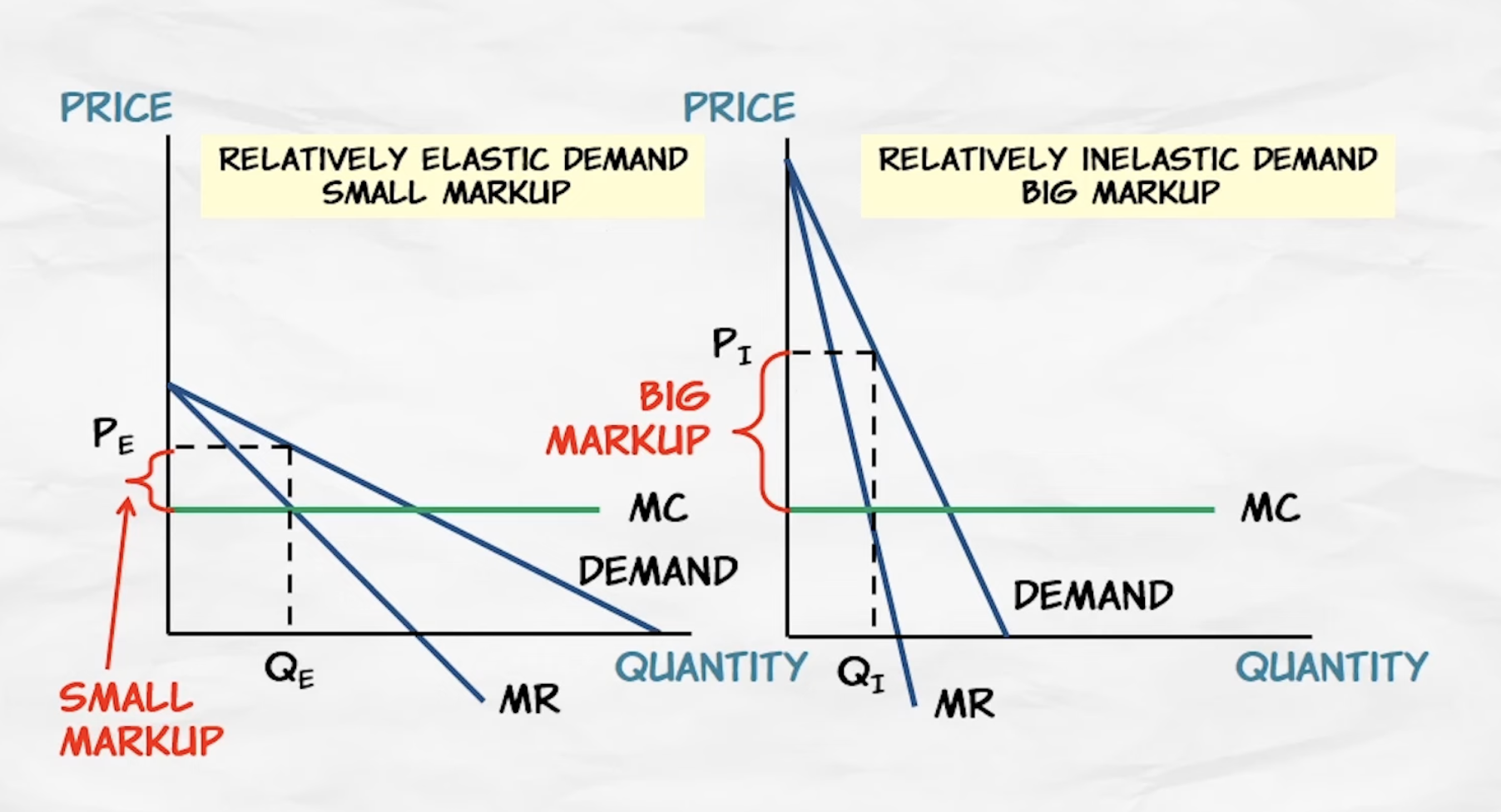

The Monopoly Markup

2 effects increase the monopoly markup for pharmaceuticals:

- The you can’t take it with you effect: people with serious illnesses are relatively insensitive to the price of life saving medicine

- The other people’s money effect: If third parties are paying for the medicine, people are less sensitive to price Conclusion: The less sensitive quantity demanded is to price (the more inelastic), the higher the markup

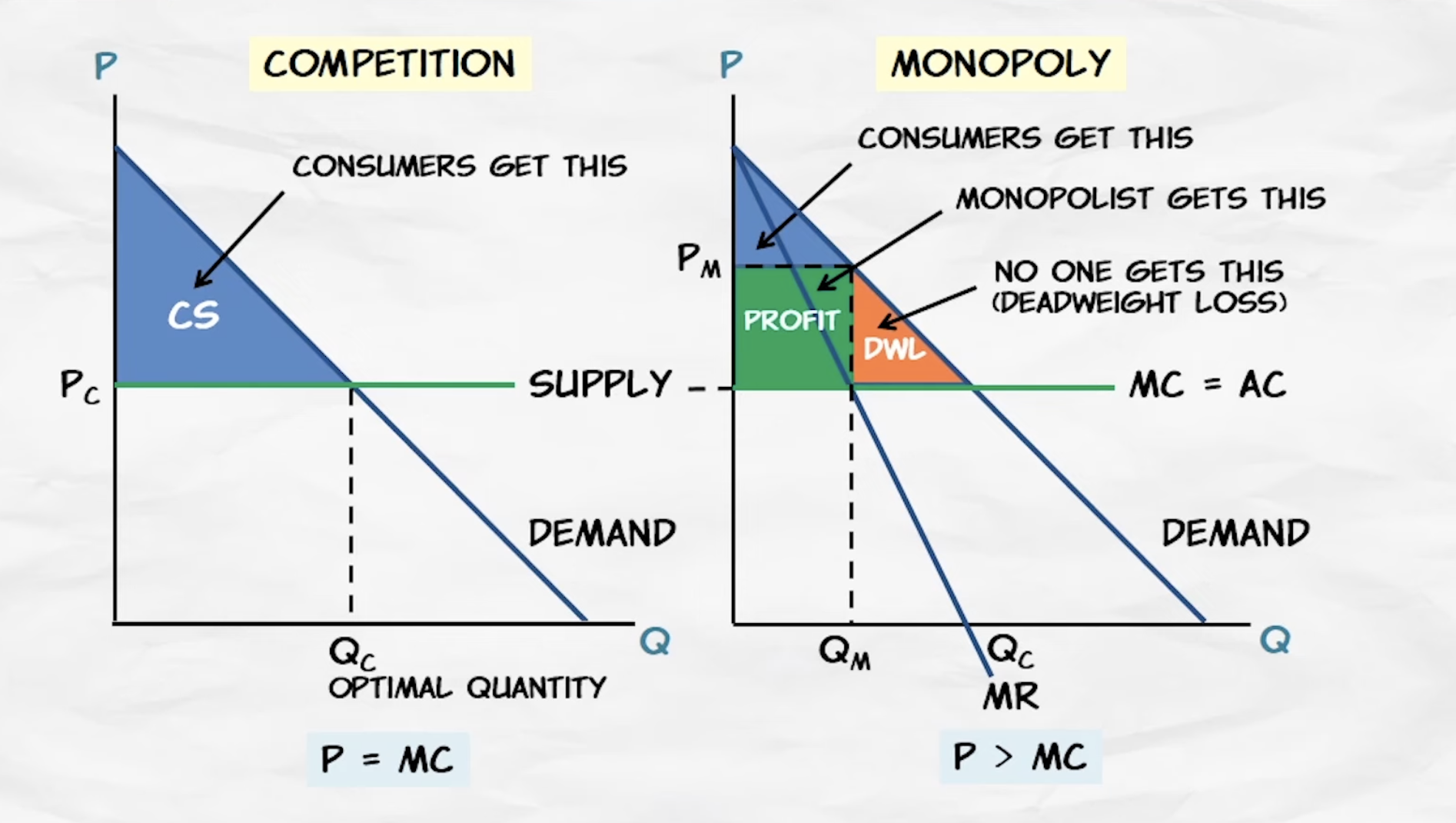

The cost of monopoly

Deadweight loss

Consumers will buy a good if the value to them is more than the price.

Under competition, price = marginal cost, so consumers will buy every unit such that the value to them is greater than the marginal cost.

Under monopoly, price > marginal cost. Too few units are produced so we get deadweight loss

The benefits of monopoly: Incentives for Research and Development

It costs a billion dollars to make the first pill, but $0.50 to make the second one

It costs a billion dollars to make the first pill, but $0.50 to make the second one

Patents cause inefficiencies so fewer drugs are produced, but producers are incentivized to develop drugs so that they can enjoy that monopoly

Price discrimination

Price discrimination is selling the same product to different groups of buyers at different prices e.g. movie theatres charging seniors, students, etc; software products have student pricing vs regular pricing

Principles of price discrimination:

- If demand curves are different, it is more profitable to set different prices in different markets

- The price should be higher in the market with more inelastic demand

- Arbitrage makes it difficult to price discriminate Arbitrage means buying low and selling high e.g. buying goods at one market and moving those goods to a second market and reselling them at a higher price

If price discrimination increases output, it is likely beneficial (i.e. different drug prices means more people get the drug). If output does not increase, welfare is reduced

Perfect price discrimination: market is segmented so that each person is charged their maximum willingness to pay Under perfect price discrimination:

- consumers end up with 0 consumer surplus

- all of the gains from trade go to the monopolist

- in a competitive market, some of the gains go to the consumer

- perfect price discrimination is efficient: there is no deadweight loss

Q. When arbitrage is easy in a market of would-be price discriminators, who is more likely to get priced out of the market: those with elastic demand or those with inelastic demand? A. Elastic demand

Tying: is a form of price discrimination in which one good, called the base good, is tied to a second good called the variable good e.g. printer and ink, phone and service plan

- The base good is pretty cheap (close to MC), and the tied goods are priced above MC

Bundling requires that the products be bought together in a bundle or package (e.g. MS Office is a bundle of programs, cable TV is a bundle of stations)

- The problem with selling MS Office programs individually is that there is a lot of variability in the demand for the products

- Zero marginal costs help. It is never wise to sell someone something if they value it at less than cost

Bundling increases profits; some of that increase comes from reduction in consumer surplus and some reductions in deadweight loss (increased sales)

- Overall, consumer welfare could go up or down

- In the big bundle, 0 marginal cost case, total welfare increases

- Goods with 0 marginal cost often have high fixed costs (software, movies/tv, information in general)

- To the extent that increased profits increase investment in fixed costs of creation – bundling will tend to increase consumer welfare as well as efficiency

- The firm makes the most profit when everyone is getting the same value from the bundle

- Bundling is almost certainly good for consumers

Q. “Bundling” in a movie or stage performance might show up in the form of adding special effects, expensive actors, or fancy costumes: Some customers might not be too interested in an Elizabethan revenge drama, but they show up to see Liam Neeson waving an authentic medieval dagger. Is it better to think of these extra expenses as “fixed costs” or “marginal costs?” A. Fixed costs

Labor Markets

Marginal Product of labour

Marginal product of labour: the increase in a firm’s revenues created by hiring an additional laborer

- It declines as more labour is added because the first labor goes to most important task, second labor to the second most important task and so on…

- Firms will hire laborers as long as wage < marginal product of labor (MPL)

Why do janitors in US earn more than janitors in India? The American office building is more productive:

- more an better capital

- office workers are more productive

- An American office produces a more valuable product So it is more valuable to keep a US office building clean, hence why janitors earn more

By definition, a labor supply curve cannot have a negative slope.

Human capital and signaling

Human capital: tools of the mind, the stuff in people’s heads that makes them productive

The sheepskin effect explains why an art history major earns more than a high school graduate in a job that doesn’t require an art history degree.

- The fact that the candidate finished college is a signal for other desirable traits that are related to the job

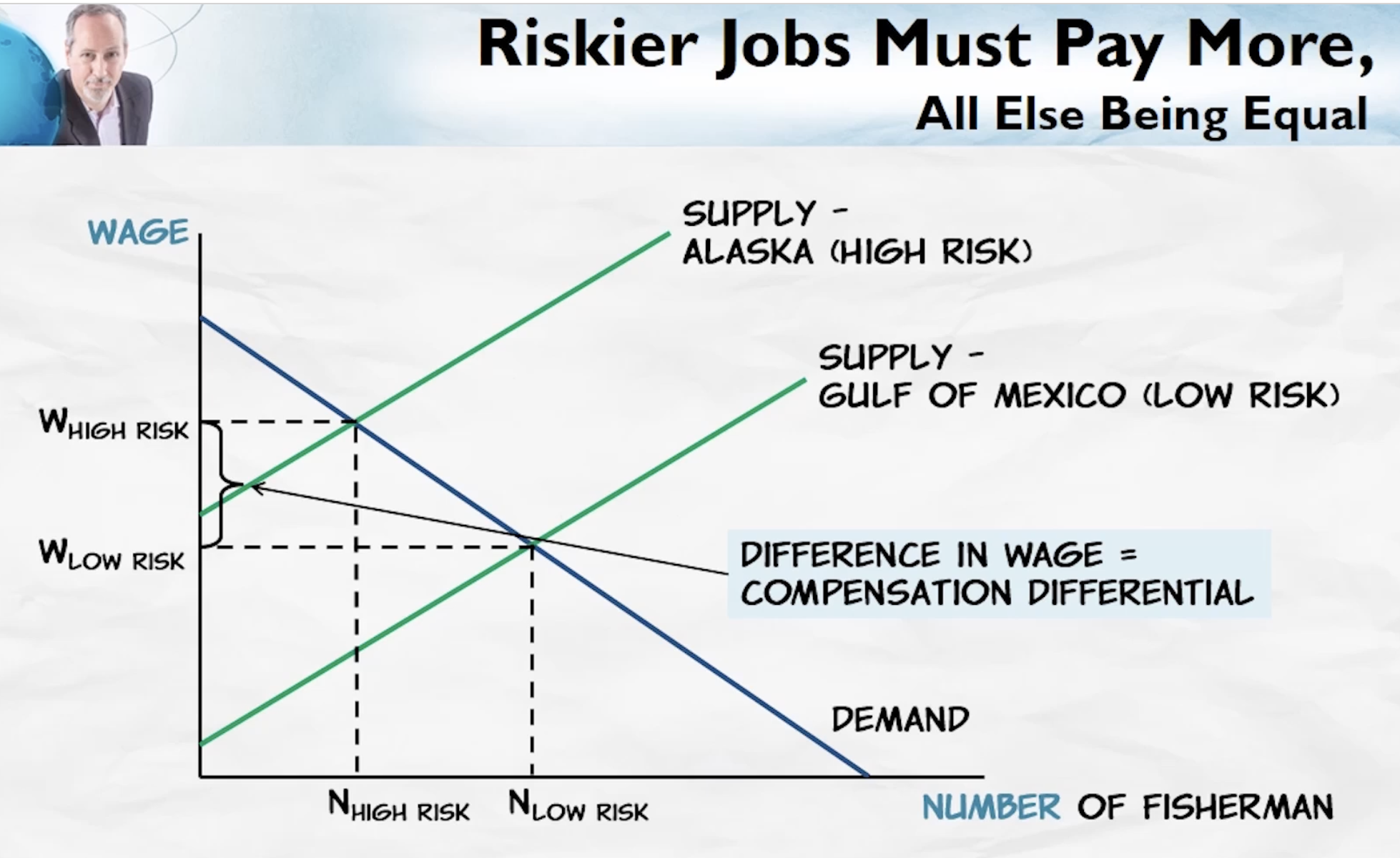

Firms have an incentive to make jobs safer so that they can lower wages

Firms have an incentive to make jobs safer so that they can lower wages

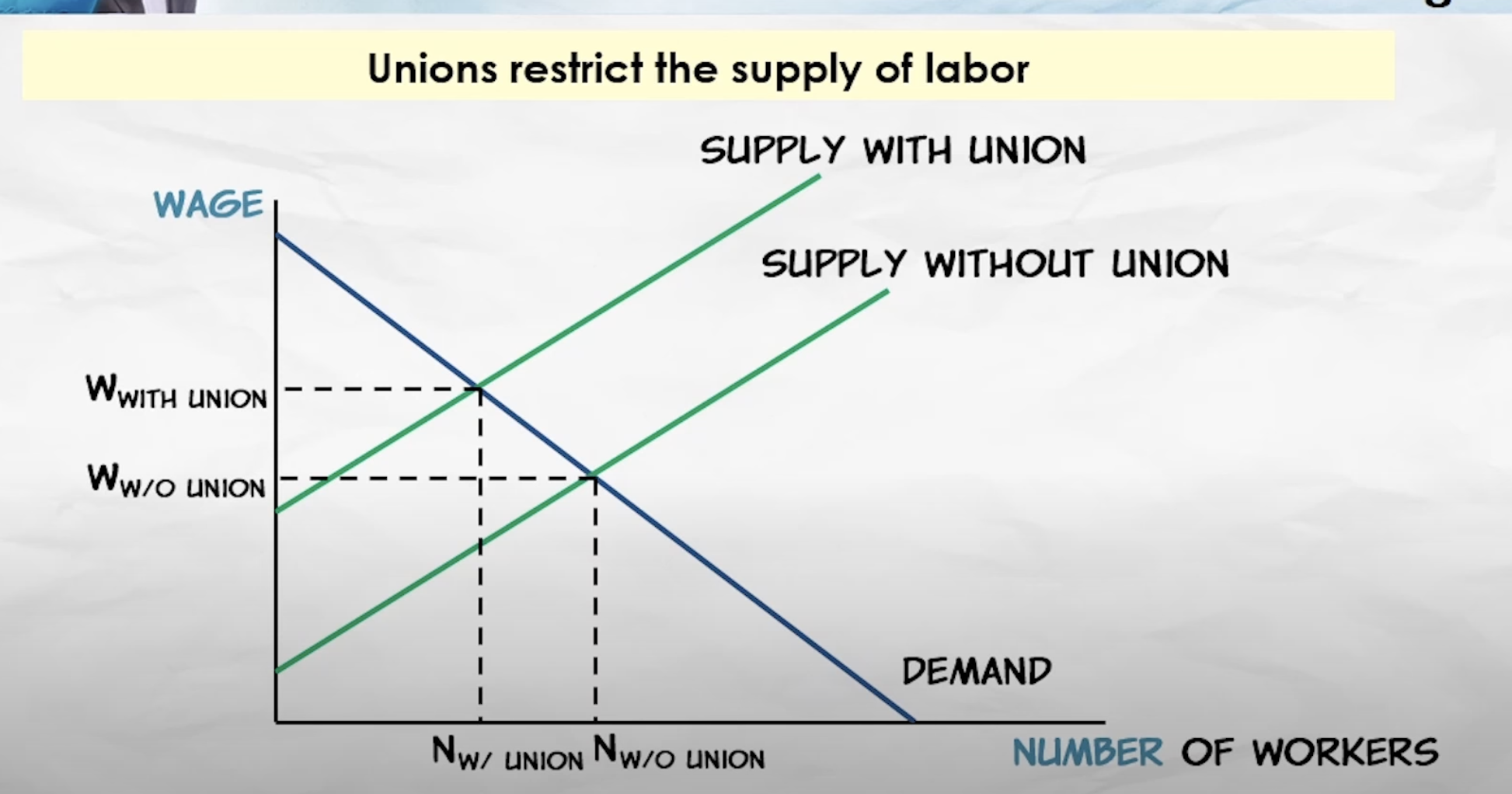

Do unions raise wages?

Unions can lower wages in the following ways:

- Workers not hired in the unionized industries seek employment in other industries, driving wages down

- Work stoppages and strikes can slow down economic growth which lowers real wages

Professional associations are esentially unions e.g. the AMA (American Medical Association). They limit the number of medical school acceptances, they lobby to make it harder for foreigners to work in the USA

Public goods and asteroid defence

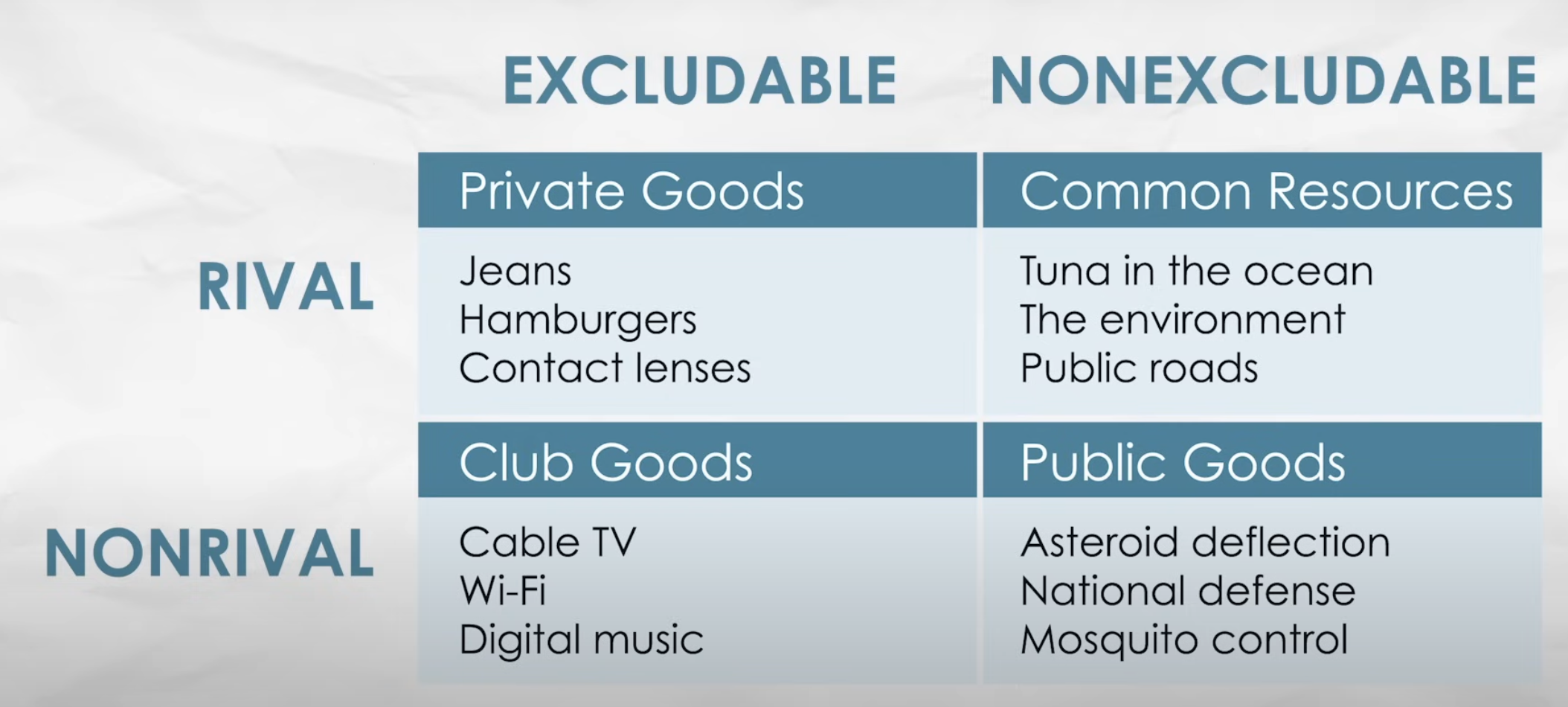

Public good is a good that is non-excludable and non-rival; meaning that it doesn’t cost more to protect other people.

- non-excludable: people who don’t pay cannot be easily prevented from using the good

- non-rival: one person’s use of the good doesn’t reduce the ability of another person’s use for the good

It is NOT a good that is produced by the government

Public goods challenge markets because nonexcludability means it’s difficult to charge non-payers (the free-rider problem) Non-rivalry means it’s inefficient to exclude anyone

How can we produce public goods?

- Taxation and government provision

“For private goods, we know that there is an invisible hand process which leads to the maximization of social surplus”

Club goods

Non-rival but excludable e.g. wifi

- having wifi doesn’t prevent someone else from having wifi (assuming minimal congestion)

- but you need a password to access it

To beat the free rider problem, you want to turn a public good into a club good

- Entrepreneurs have done this through advertising

- When you watch NBC, you don’t pay anything (price = 0), and it doesn’t cost them anything to beam the stream to you (MC = 0). P=MC=0 which is efficient

- But you have to watch the adverts, and they sell those adverts

- Same thing for Google

- They turned something that is non-rival and non-excludable into something valuable

Tragedy of the commons

Common resources are rival but nonexcludable e.g. tuna in the ocean

- nonexcludable because there are no property rights in the ocean

- rival because one more tuna for you = one less tuna for everyone else

- This leads to the tragedy of the commons

The tragedy of the commons is the tendency of any resource that is unowned, and hence nonexcludable, to be overused and undermaintained

In the case of tuna, the fishermen don’t have an incentive to maintain the stock of tuna because that would leave more for their competitors. Contrast this with a chicken farmer: him selling less chicken to day will lead to him selling more tomorrow (because the remaining chicken will lay and hatch into more), so he has an incentive to preserve them.

Remedies for the tragedy of the commons:

- Command and control: People end up gaming the system. They slow down the tragedy but don’t prevent them

- Cultural norms: Overfishers get disapproved, those who honor the norms are respected. Can be effective in small, self-governing communities

- Creating property rights (making it excludable): New Zealand created tradeable allowances called ITQs (Individual Transferrable Quotas)

“In the Coase theorem, the more parties there are in an agreement, the more transaction costs are incurred and the less likely the agreement is to happen”

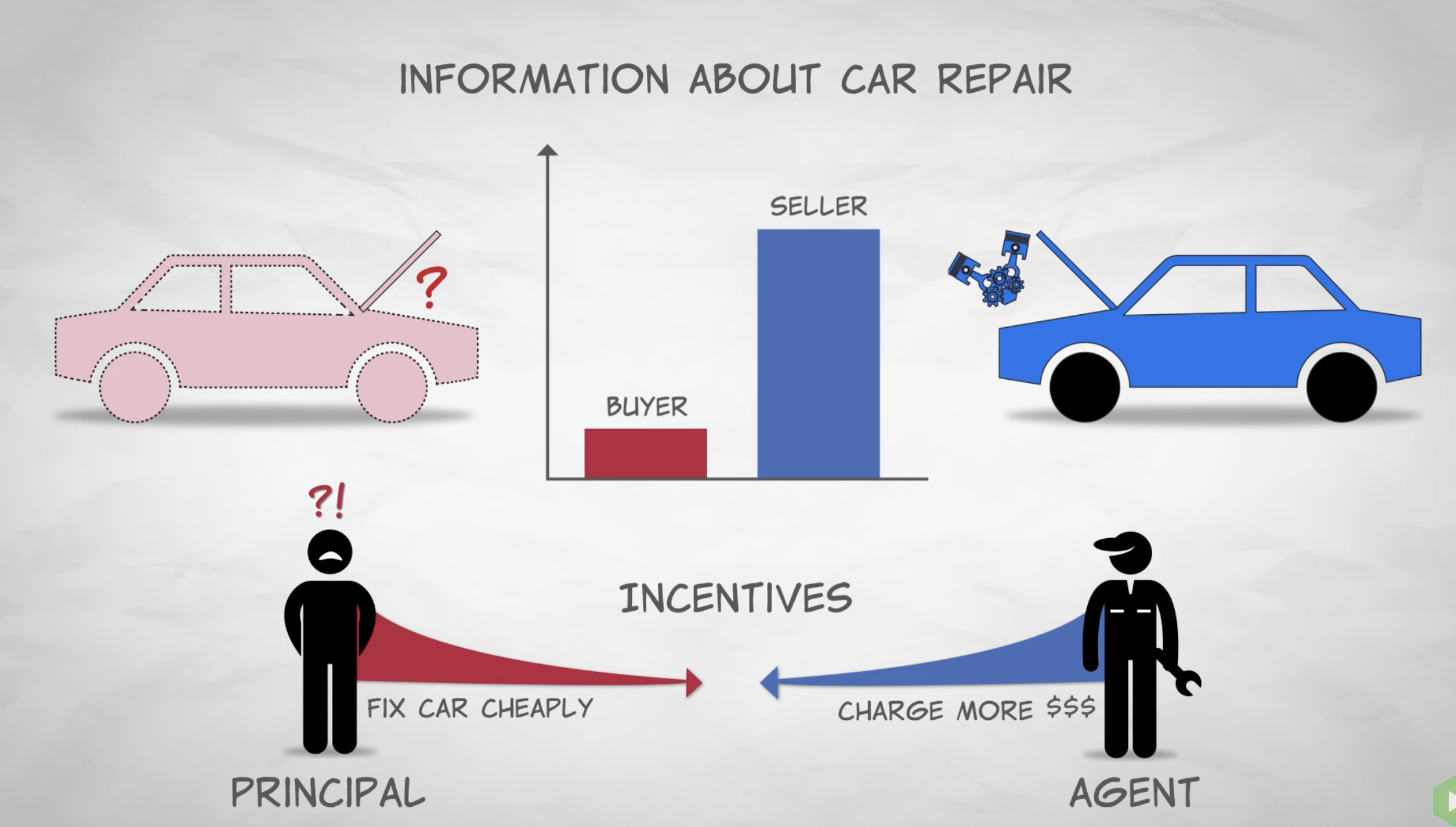

Asymmetric Information

Asymmetric information: Where one party has more/better information than the other party has

Adverse selection: When an offer conveys negative information about what is being offered.

Propitious selection also known as advantageous selection, refers to a phenomenon in insurance markets where high-risk individuals are less likely to purchase insurance, leading to a favorable selection of lower-risk individuals (and thus lower-cost customers) remaining in the insurance pool. This concept challenges traditional adverse selection theory by suggesting that individuals who are more risk-averse are not only more likely to buy insurance but also more proactive in reducing their risk of loss.

Moral hazard: the risk that one party in a contract will behave recklessly or irresponsibly because they don’t bear the full costs of their actions, and another party will bear those costs instead. (e.g. a boss may hire an employee to do work but the employee may goof off without the boss knowing (asymmetric information)) Can be solved by:

- User ratings/reviews: they give more information about the seller

- Sellers become more incentivized to stay reputable so that they have future buyers

- Modifying incentives

- In some states, home inspectors are not allowed to sell services to fix the issues they identify.

The principal agent problem: An inherent conflict of interest and differing priorities between a principal (e.g. an owner) and their agent (e.g. a manager), where the agent may act in their own self-interest rather than the principal’s, often due to asymmetric information.

- Can be solved by aligning incentives

A signal: an expensive action that reveals information.

Sheepskin effect: a phenomenon in applied economics observing that people possessing a completed academic degree earn a greater income than people who have an equivalent amount of studying without possessing an academic degree.

There is asymmetric information between an employee and employer. The employer doesn’t know how smart or conscientious you might be, but a degree provides a credible signal about these traits (because getting a degree is harder for people who don’t have these traits)

Consumer choice

Marginal utility: Additional satisfaction/benefit a consumer receives from consuming one more unit of a good or service Goods have diminishing marginal utility. Each additional good brings less satisfaction than the previous one

Combining your budget constraint with your indifference curves can help you see how to get maximum utility given your resources. Any point at which your budget constraint lies tangent to an indifference curve is an optimal combination of pizzas and coffees. Why is it optimal? Two simple reasons: 1) You can afford it, and 2) it will give you the most happiness (aka utility).

Bonus Topics

Game theory

Nash equilibrium: Situation where no person has an incentive to change their behaviour or strategy, unless someone else changes their behaviour or strategy.

In a single prisoner’s dilemma problem:

- the best/dominant strategy is to cheat (break the promise)

- the nash equilibrium is for both of them to cheat (break their promises)

- This isn’t the optimal outcome. If they both kept their promises, they would both get a better reward